As I’ve mentioned before, I’m a big fan of the Howard Stern Show. I have been since my girlfriend (at the time) introduced it to me in 1993 (for this I can almost forgive her the broken heart). I followed Stern to Sirius and consider the show to be better than ever. One contributing factor: while there are still too many commercials, they are far fewer in number than they were on “testicle” radio.

Thankfully the national nature of his show spares us listeners from the endless hammering we used to get from the local auto dealers, brake shops, and Guitar Centers. God, how I don’t miss those! This is not to say that the current crop of advertisers is any better, though. Given the quality of the ones who remain, I can’t help but worry about the future of Stern’s employer. Apparently Stern has already paid for himself. Nonetheless, Sirius has yet to show any earnings, and its stock appears to be languishing at around $4.50 a share, off from a high of almost $8 back in early January (sadly I bought when it was over $5—What can I say?). I can’t help but wonder if there might not be an element of desperation behind their decision to accept, as Stern show advertisers, companies like The Prosperity Automated System (PAS) and The Smith & Merritt Institute (S&M).

PAS is a pure Ponzi scheme. Unlike companies like Amway/Quixtar or ACN, PAS doesn’t even pretend to have any product, other than the system itself. This is such a huge red flag I am convinced they are mere days away from being shut down by the FTC (then again, when has the federal government ever been on top of anything—except for threats to its own revenue, that is?).

I have less of a problem with Smith & Merritt, but my recent foray into the world of the get-rich-quick scammers has made me hypersensitive, I suppose. Like Burley’s 7 Levels and Kiyosaki’s Cash Flow Quadrant, S&M have a catchy little slogan that they undoubtedly hope will be the “hook” that catapults them to fame, fortune, and guest spots on Oprah: “Spend Your Way to Wealth.” If that isn’t enough of a red flag, a visit to their web page isn’t helpful. They don’t seem to have any “products” for sale—except a “Free Report and Consultation,” which has to be some sort of loss-leader designed to get you to buy the “real” (and no doubt “real expensive”) stuff, whatever that is. It’s all pretty vague.

The stuff they say on their blog seems pretty harmless and vanilla (“Stay out of debt” and “live within your means” are common refrains—clearly different and less catchy messages than “Spend your way to wealth,” though, huh?), but some of what they say is a little odd, some shows a disturbing lack of economic understanding, some suffers from extreme oversimplification, and some of it just plain wrong.

Examples:

In this post they decry the “rampant poverty” throughout the world. I’m not going to disagree that there are people today who live in appalling conditions. On the other hand, when you compare the living standards of today’s poorest Americans and Europeans with those of people from just 50 years ago, you can’t help but feel that there really is no such thing as poverty in the West any more. But the US is where S&M are focusing their efforts. And their “solution” to world poverty? “Live Abundantly!” Seriously. I wonder how well that advice would go over in Darfur.

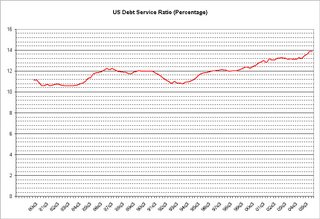

Not surprisingly, they repeat the tired canard that personal debt is soaring. However, take a look at the Federal Reserve Data for the debt service ratio for Americans over the past 25 years:

Does that look like “soaring” to you?

They think that Pay Day Loan places should be made illegal. As I point out to them in the post’s comments [UPDATE July 6th: My comment there has been deleted!], this would likely have the perverse effect of hurting the very people S&M claim they would like to see helped. See here for an excellent explanation for why that is the case.

They think it’s a good idea for everyone to pay off their mortgage ASAP. However, if you’re paying less than 7% interest and you’re also saving for a retirement that is still a couple decades out, it makes far more sense to put as much money as possible into your retirement fund, where your returns are likely to be a lot higher than 7%, especially if you’re using an IRA or 401K (due to their tax advantages).

In a similar vein, they say you should amass an emergency cash reserve prior to paying off your high-interest debt. I think this is absurd. If you’ve got revolving credit card debt costing 18%, why would you set aside thousands of dollars, meanwhile, in a low-interest-bearing savings account instead of using the money to pay the credit cards off as fast as possible? Doing it that way is more expensive and thus slows the process down. I think you should start amassing the emergency funds once the credit cards are paid off. Cancel all the cards except one, which you keep at a zero balance. Use it as your emergency cash reserve until you actually have a real one to use.

They call Adjustable Rate Mortgages “evil,” but fail to mention that sometimes they make sense. Why pay a relatively higher 30-year interest rate on a home loan that you know you’ll only be paying on for 5 years, because you plan to move to a new place at that point or sooner (this is what most people—especially first time homebuyers—do)?

I can get behind the message to pay off your debts and always live within your means (but who would disagree?). The rest of it, though, is highly questionable, and I sincerely hope Sirius and the Stern Show are able at some point to land some less annoying advertising contracts.

Tuesday, July 04, 2006

Advertise Your Way To Wealth

Posted by

Einzige

at

9:23:00 PM

Subscribe to:

Post Comments (Atom)

7 comments:

I disagree on the emergency cash reserve issue. The reason they give for doing the cash reserve first is sound--to make sure that you can cover the inevitable short-term emergencies without going further into debt. Breaking the debt habit is a slightly higher priority, in other words.

Dave Ramsey's "financial peace" program gives the same priority--the first goal is to put $1000 into savings. Note, however, that he distinguishes this from an emergency fund of 3-6 months salary, which he doesn't suggest you accumulate until after you've eliminated your credit card debt.

Given your distinction ($1000 versus 3-6 months worth of salary), I am willing to concede this point.

I never cease to be amazed that 30 year fixed rate home loans are even available in the USA.

We don't have them in Australia. I remember once a guy I knew who had a 5 year fixed rate home loan (which are available) which he paid off two years early.

He was charged quite a lot of money in early repayment fees and interest adjustments.

Just trying to fathom how much the interest adjustment would total if you paid a 30-year fixed rate home loan off after 5. Given that yield curves are going up at the moment, this appears to be a number followed by quite a lot of zeroes.

If 30-year fixed rate loans are so popular over there, how the hell does the Fed police Monetary Policy at all?

Are you saying the guy's loan was amortized over 5 years, or that the first rate adjustment was after 5 years?

Not sure what you mean by amortized.

His fixed rate was for a period of 5 years.

During which time, he was required to make principal and interest repayments as per normal, based on the loan term which I believe was 25 years, but I'm not sure, but not allowed to make any more than a certain amount of extra repayments without charges.

He paid it off (i.e. to zero) after about three years after a large inheritance.

His final payment (three years after he started the fixed rate and two years before the fixed rate finished and reverted to a variable rate loan) included a fee for early repayment and the interest adjustment.

I think the interest adjustment was a couple of thousand dollars, too.

By "amortized" I was talking in this case about the length of time required to pay back the loan. In the US it's typically 30 years, though 15 year loans are quite common, too.

I understand down under it's usually 25 years.

Thanks for the clarification! Crazy that the guy paid it off so fast!

Sorry about your comment being deleted off of the Smith and Merritt Blog. It was done by accident while deleting a bunch of spam and changing the format to moderated to keep problems like that from happening in the future. It was my fault, not Dan and Kathryn's.

If you would like to send an email with questions about their entire philosophy, I'm sure they would enjoy writing a post about your various questions. While you might not agree with all they have to say, their basic approach is a very conservative one, slowly growing your wealth. They stay far away from quick rich schemes and the like.

Oh, who am I? I'm the guy that posts what they write and keeps the site clean.

Feel free to email me at sevensen@smithandmerritt.com.

Regards,

Scott Evensen

Post a Comment