Although The Daily Reckoning is usually a bunch of alarmist doom-and-gloom, today's feature definitely worth reading. It's a little article that explains in clear and simple language why using corn ethanol as a fuel source will be, for the near future at least, an exceptionally wasteful and environmentally unfriendly practice. Check it out!

Friday, July 28, 2006

Thursday, July 27, 2006

Should I Be Annoyed?

I obviously haven’t been blogging much, despite intentions to the contrary. Here’s an explanation why:

To: Einzige

From: [Company Managers]

Subject: Assumption of role as ‘Acting Supervisor of Quality Assurance’

Date: July 17th, 2006

On Friday July 14th [Boss Man] discussed the opportunity to become ‘Acting Supervisor of QA.’ If you chose you would assume the role of supervisor of your functional area—Quality Assurance—on a temporary basis for a projected period of not more than 3 months. This would allow the current manager…to transition to her new role within the organization.

We addressed that the organizations requirements for the manager of a QA were considerably more experience and more actual management experience running a dept. [sic] We mentioned that should your performance of these duties be satisfactory we would give consideration [emphasis original] to your assuming the role. This was and is not a guarantee of an automatic promotion or assumption of those duties.

In consideration for assuming these duties temporarily you would receive a $1500 bonus in your August pay and another bonus of $1500 in your September pay if you are performing in that role satisfactorily.

During the week of 7/17, [Boss Man] will meet with you to set the specific expectations for this ‘acting supervisor’ role. We request that you summarize those expectations in your own words so that we can include them in your file with this written confirmation of this agreement and your discussion with [Boss Man].

If after the discussion of expectations you feel that they are unclear or if during your performance of your duties you come upon any problems that you are unable to resolve please do not delay in bringing those problems to [Boss Man’s] attention immediately.

Please sign a copy of this email and bring hard copy to the HR office.

________________Signature

________________Date

I find myself alternately pleased and annoyed about this. For one thing, I have almost 10 years in QA, with over 3 of those in a management capacity of some sort, including managing a team of up to 9 people for over a year. During the initial discussion, mentioned in the letter above, with Boss Man, he seemed a little taken aback when he learned this about me. And thus the pendulum swings to the other side: it’s true that the managers of this company haven’t seen much from me, since I’ve basically been cloistered in the QA department, stuck underneath a “manager” who has never been an effective advocate for the department—or even reasonable QA practices. I learned, after a while, that my complaints and suggestions might as well have been made to the wall. Given this, perhaps management’s lack of trust in my capabilities is understandable.

Nonetheless, no follow-up discussion has yet taken place, and I wouldn’t even have gotten a hold of this email if it weren’t for my going to talk to the HR director about concerns I had that nothing of the original talk had been put in writing. So, I still do not know what it means to “perform in this position satisfactorily.” Worse, the timing of the transition happens to be during one of the worst “crisis mode” crunch times in the history of this company, which is basically always running in crisis mode.

Note also that I am apparently only vying to become a “permanent supervisor,” as they are planning on hiring a “real” manager as soon as they can find someone with over 4 years as a manager and 10 years in QA (thus “out ranking” me). I’d still be getting $18K per year more than I make now, so while all this “manager/supervisor” bullshit does bother, it's not by too much.

An extra $3000 over the next month or so is undoubtedly an attractive carrot, as well, and I have found myself working a lot of extra hours this past couple weeks, with more ungodly overtime planned for the next couple of weeks, in the hope of making a good impression (and getting stuff done that has needed doing for a long time - another rant in an of itself), even though I still don’t know the definition of “satisfactory.”

Finally, all this comes while I’ve been making a concerted effort to find a job in Phoenix and move back there, since it’s where the bulk of my family and friends reside. Should I put that on hold and focus on getting the bonus money? If I do end up getting the “permanent” supervisor role, should I stick with it for a year and leverage my way into a better paying job in Phoenix in a year or so?

This is all so annoying.

Thursday, July 20, 2006

Wherein Love of Music?

My grandmother tells me that when I was barely a year old, to get me to settle down for a nap, she would play an LP of Beethoven's Ninth Symphony. Apparently I would lay there quietly with my eyes closed - asleep, by all appearances - but as soon as the record would end my eyes would open and I'd point at the record player and grunt until she would start it up again. Beethoven has always been my favorite composer - and the Ninth, to this day, remains awe-inspiring.

When I was eight I heard Pink Floyd's On The Run. From the instant I heard it I was fascinated. I've been a Floyd fan ever since, though I was disappointed to discover that not all of their stuff sounded like that. I was fated to wait several more years, yet, before the premier of Risky Business. I still vividly remember the moment when, during the opening credits of the film, the words "Music Composed and Performed By Tangerine Dream" appeared on the screen. I thought to myself, "That's an interesting name..." - and then the music started! At the time I was a big fan of Devo, Yaz, and Thomas Dolby, but I realized then and there that subconsciously I had been waiting for music like this all my life! I became obessessed with finding everything I could by Tangerine Dream. Thinking about it, now, it's kind of hard to imagine a time before Google, when looking up a band's discography was actually somewhat difficult and usually involved physically visiting a library and using a card catalog!

All of this, I think, gives strong evidence for a genetic origin to the enjoyment of music. This is no surprise, really, given recent research with twins (among other things, like the fact that my cats don't crowd around the speakers when a good song is on). On the other hand, I find it strange that both my father and my grandfather are profoundly unmoved by music. They could literally never listen to a strain of music again and feel none the worse for it. Such a sentiment is completely alien to me.

My mother enjoys music, but mainly as a performer, and she seems to have no quality control (sorry mom! :-) ). Maybe, like eye color or male pattern baldness, that's all that's required for a genetic origin, but I doubt we could call it definitive.

It would seem the nature/nurture debate must rage on.

Wednesday, July 12, 2006

Electronic Music, Digital Culture

For me, it is music—more than any other single thing—that makes life worth living. You may have already guessed this from my large collection of electronic-music-related links in the sidebar. Listening to music is often a sensual, visceral thing for me, like enjoying a particularly decadent slice of cheesecake. The right song at the right moment (usually something by Orbital, or maybe Beethoven) has been known to cure week-long funks I was otherwise sure would continue indefinitely. It’s the closest I get to calling something a reverent or spiritual experience (and I suspect my experiences are just as “transcendent” as any religious person's).

So, you might wonder why I don’t blog about music more often. Well, as someone smart once said, “Writing about music is like dancing about architecture—it’s a really stupid thing to want to do.” One’s tastes in music are about as rational as one’s tastes in ice cream—and, besides, mine are decidedly outside the mainstream. Moreover, I have no interest in making Die Eigenheit more shamelessly self-indulgent than it already is.

Having said all that, I do find myself sometimes wondering, “What is Die Eigenheit about, if it isn’t my peculiarity, hmmm?” I can’t come up with a good answer to that question at the moment (though you might reasonably wonder why I didn’t call the blog “Meine Eigenheit”), so I hope you’ll allow me a little self-indulgence, here. I’d like to recommend that you check out one of my favorite web sites—the one that, for good reason, tops my list of music sites: Static Beats.

If you’re a music lover, but disdain electronic music, then I don’t begrudge you your preferences, but consider this: Does your exposure to it consist entirely of brief stints at the meat-market “techno” clubs, bombarded with the relentless thud-hiss-thud-hiss-thud-hiss that your annoying friends call “electronica” (retch!)? If so, I submit you are unfairly judging an art form by its worst representatives. It’s as if you condemned all of Rock and Roll on the basis of hearing only Poison or Whitney Houston. Give the Static Beats webcast a listen with an open mind and see if you’re not pleasantly surprised at the breadth and depth that genuinely artful electronic music has to offer. Take it from someone who has been a die-hard electronic music fan since the first time he learned about the letter W watching Sesame Street (I’m sorry I can’t provide a link to a video that would clarify the reference. You'll just have to trust that I'm actually making sense, here).

If you are a fan of electronic music then you really couldn’t ask for more. What you can count on from Static Beats is a steady stream of innovative artists on the forefront of the genre, mixed in with just the right amount of classics from the past. The site showcases so much good music that I’m almost scared not to listen to it, because of what I might miss. This has a bit of a downside, though, too, because discovering two or three new must have artists per week is way more than I have the money for. My Amazon Wish List is getting unwieldy as a result, and I’ve taken to forcing myself to listen less frequently nowadays.

Anyway, I hope you enjoy it even half as much as I do!

Monday, July 10, 2006

Smith & Merritt – Spend Your Way to Lameness?

I know I mentioned this briefly in the update to my previous post, but it still irks me, so I thought I’d bring it up again.

Back on July 3rd I put a comment up on the blog of the “Spend Your Way to Wealth” guys, Smith & Merritt—specifically on their post about Payday loan places. By July 5th my comment had been removed. Admittedly, of course, it’s their prerogative to decide what can and can’t be up on their blog, but consider what they say in this post:

Feel free to play rough and tumble, challenge us, ask us questions. All we ask is you keep it polite. No foul language or rudeness. We love a good dialogue and we love explaining why we believe the way we do. Still, we do reserve the right to edit posts if we determine them to be offensive.They apparently have an unreasonably broad definition for the term “offensive” (as well as “edit”). I certainly didn’t use any foul language. Nor was I rude—unless they define “rude” as any disagreement with them. Unfortunately I did not save a copy of exactly what I wrote, but here is the gist of it:

Payday loan places may be a “scourge,” but how will making them illegal be helpful to their typical customer? Reducing a person’s available options seems rather likely to hurt them, instead.It was something like that, anyway. Does that seem rude or offensive to you? If not, then why do you suppose they removed the comment?

If you truly believe that these businesses are overcharging their customers, then this suggests a profit opportunity. Why not set up a competitive shop in the neighborhoods where you find these places and then undercut them? I suspect, though, that their near-ubiquity means that they are already quite competitive with one-another, and are thus already charging the lowest price the market will bear. This means that making them illegal will almost certainly result in making credit even more expensive for the very people you are complaining are already being overcharged! How is what you suggest, then, going to be helpful?

Subsequent to the deletion of my first comment I wrote a second one expressing my disappointment at what I saw as cowardice on their part. Not surprisingly, that one was also quickly removed. Could it be that Smith & Merritt have no room for gray areas when it comes to debt? Unfortunately, if you are faced with a situation where you have to choose between spending an extra $50 or having your electricity shut off for 2 weeks, then sticking your head in the sand, as Smith & Merritt would apparently counsel you to do, isn’t going to help.

Tuesday, July 04, 2006

Advertise Your Way To Wealth

As I’ve mentioned before, I’m a big fan of the Howard Stern Show. I have been since my girlfriend (at the time) introduced it to me in 1993 (for this I can almost forgive her the broken heart). I followed Stern to Sirius and consider the show to be better than ever. One contributing factor: while there are still too many commercials, they are far fewer in number than they were on “testicle” radio.

Thankfully the national nature of his show spares us listeners from the endless hammering we used to get from the local auto dealers, brake shops, and Guitar Centers. God, how I don’t miss those! This is not to say that the current crop of advertisers is any better, though. Given the quality of the ones who remain, I can’t help but worry about the future of Stern’s employer. Apparently Stern has already paid for himself. Nonetheless, Sirius has yet to show any earnings, and its stock appears to be languishing at around $4.50 a share, off from a high of almost $8 back in early January (sadly I bought when it was over $5—What can I say?). I can’t help but wonder if there might not be an element of desperation behind their decision to accept, as Stern show advertisers, companies like The Prosperity Automated System (PAS) and The Smith & Merritt Institute (S&M).

PAS is a pure Ponzi scheme. Unlike companies like Amway/Quixtar or ACN, PAS doesn’t even pretend to have any product, other than the system itself. This is such a huge red flag I am convinced they are mere days away from being shut down by the FTC (then again, when has the federal government ever been on top of anything—except for threats to its own revenue, that is?).

I have less of a problem with Smith & Merritt, but my recent foray into the world of the get-rich-quick scammers has made me hypersensitive, I suppose. Like Burley’s 7 Levels and Kiyosaki’s Cash Flow Quadrant, S&M have a catchy little slogan that they undoubtedly hope will be the “hook” that catapults them to fame, fortune, and guest spots on Oprah: “Spend Your Way to Wealth.” If that isn’t enough of a red flag, a visit to their web page isn’t helpful. They don’t seem to have any “products” for sale—except a “Free Report and Consultation,” which has to be some sort of loss-leader designed to get you to buy the “real” (and no doubt “real expensive”) stuff, whatever that is. It’s all pretty vague.

The stuff they say on their blog seems pretty harmless and vanilla (“Stay out of debt” and “live within your means” are common refrains—clearly different and less catchy messages than “Spend your way to wealth,” though, huh?), but some of what they say is a little odd, some shows a disturbing lack of economic understanding, some suffers from extreme oversimplification, and some of it just plain wrong.

Examples:

In this post they decry the “rampant poverty” throughout the world. I’m not going to disagree that there are people today who live in appalling conditions. On the other hand, when you compare the living standards of today’s poorest Americans and Europeans with those of people from just 50 years ago, you can’t help but feel that there really is no such thing as poverty in the West any more. But the US is where S&M are focusing their efforts. And their “solution” to world poverty? “Live Abundantly!” Seriously. I wonder how well that advice would go over in Darfur.

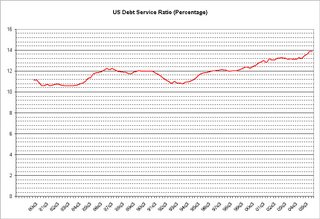

Not surprisingly, they repeat the tired canard that personal debt is soaring. However, take a look at the Federal Reserve Data for the debt service ratio for Americans over the past 25 years:

Does that look like “soaring” to you?

They think that Pay Day Loan places should be made illegal. As I point out to them in the post’s comments [UPDATE July 6th: My comment there has been deleted!], this would likely have the perverse effect of hurting the very people S&M claim they would like to see helped. See here for an excellent explanation for why that is the case.

They think it’s a good idea for everyone to pay off their mortgage ASAP. However, if you’re paying less than 7% interest and you’re also saving for a retirement that is still a couple decades out, it makes far more sense to put as much money as possible into your retirement fund, where your returns are likely to be a lot higher than 7%, especially if you’re using an IRA or 401K (due to their tax advantages).

In a similar vein, they say you should amass an emergency cash reserve prior to paying off your high-interest debt. I think this is absurd. If you’ve got revolving credit card debt costing 18%, why would you set aside thousands of dollars, meanwhile, in a low-interest-bearing savings account instead of using the money to pay the credit cards off as fast as possible? Doing it that way is more expensive and thus slows the process down. I think you should start amassing the emergency funds once the credit cards are paid off. Cancel all the cards except one, which you keep at a zero balance. Use it as your emergency cash reserve until you actually have a real one to use.

They call Adjustable Rate Mortgages “evil,” but fail to mention that sometimes they make sense. Why pay a relatively higher 30-year interest rate on a home loan that you know you’ll only be paying on for 5 years, because you plan to move to a new place at that point or sooner (this is what most people—especially first time homebuyers—do)?

I can get behind the message to pay off your debts and always live within your means (but who would disagree?). The rest of it, though, is highly questionable, and I sincerely hope Sirius and the Stern Show are able at some point to land some less annoying advertising contracts.

Sunday, July 02, 2006

Index to My John Burley Posts

Well, I’ve finally said all that needs to be said about John Burley (I hope)! 23 posts in all—over a third of this entire blog. Somewhat ironically, most people who find Die Eigenheit via the search engines do it with some variation of the key words john burley progressive profits scam, which takes them to my shortest Burley post, which is a post that directs them to other skeptical sites! Bummer.

Anyway, since I’ve written so many posts critical of John Burley and his real estate investment “advice” over the past several months, I figured it would be a good idea to create a single post that links to all of them, with short descriptions of the contents of each. I guess that’s not an index, really. More like a table of contents, I suppose. I’ve listed them in a suggested reading order, but feel free to skip around.

I recommend you start with A Brief Introduction, which goes into why I decided to write all these criticisms of John Burley and gives the barest sketch of what exactly a “wrap” is.

Next, check out my post that asks, “Is John Burley a ‘guru,’ or a fraud?” I take a detailed look at the claims John Burley makes on The Secrets of Professional Investors Made Easy, a tape set of Kiyosaki’s 1997 seminar in Australia which featured John Burley. Of course it’s impossible to say that Burley is running a scam without creating an exposure to charges of libel, so I leave it to you, the reader, to answer the question in the post’s title yourself.

I recommend you then check out my post on John Burley’s 7 Levels of Investor. I notice that Burley has very recently updated his web site (and in the process broken all of my links to his pages!), to better highlight what has basically become his “brand.” It’s smart to stick with what works, no doubt. Interestingly, he’s allowing people to review his products directly on his site. That could be fun! Will he be able to handle the negative reviews?

You might then be interested in reading my review of John Burley’s book, Money Secrets of the Rich. I highlight some pretty incredible claims that he makes.

As you probably know, John Burley has a “Boot Camp.” Is it really worth $5000? I doubt it. In my post on John Burley’s Dog and Pony Show I give one reason why.

Burley used to publish a quarterly newsletter (maybe he still does. I’m not sure). I compare the advice he gives in one of them with the advice that you’ll get out of your newspaper’s horoscope. See if you can tell the difference.

Burley’s biggest claim to fame is, arguably, the “hundreds” of houses that he owns. I took a look at the public record in an attempt to figure out the real number. It’s actually higher than I thought it was going to be. You can read more detail in the post on Burley’s Investment Properties and Investor Partners.

Given all those houses, Burley has to have some way of finding home sellers and then attracting homebuyers. One way, it seems, is with an eBay Store. Another way is with a website. I should point out that I have been watching ez2own1.com for several months, now, and I haven’t once seen an old property come down or a new property go up. I am therefore convinced that ez2own1.com is a dummy site (though the properties listed are, in fact, Burley houses). Now that Burley seems intent on revamping his web pages, however, we may soon see this changed. I will update this post as needed.

Burley sells houses to people with bad credit. Not surprisingly, this leads to a lot of foreclosures.

Burley loves to crow about his high returns on investment. I tackle his claims based on economic theory in this post, and then follow that up with a more concrete analysis in this post. Then I top it all off with this one, where I look at what Burley had to give up to become a "guru."

As I mentioned above, there are other skeptical sites out there on the web, but not many. I highlight a couple of them.

In my transactions and legal entities posts I present some raw data I pulled from the public record, mostly in preparation for my more detailed posts later on.

Burley has many “students.” He claims that his students’ success rate is the best in the business. I liken the behavior of some of these people to what you might see in a religious cult, which is why I decided to call them “Burleyists.” I’ve written a number of posts highlighting a particular person and what makes them interesting. You can find them here:

Mike Hay

Chris Bridgeman

ChavaRica

Robyn Grinter

Robert Yang

A Burleyist?

Troy Mann

Joe Arlt

That’s it! I don’t foresee writing any more John Burley posts, but you never know. If I do, though, I’ll be sure to put a link to it here.

Update: John Burley's Latest Antics - I wonder why Burley borrowed such a huge chunk of money and won't talk about it.

Saturday, July 01, 2006

John Burley's Opportunity Cost

In my previous John Burley post, I touched briefly on the value of Burley’s time. I’d like to revisit this topic here, exploring its implications in more detail.

Recall that John Burley moved from Northern California to Phoenix in late 1990, leaving behind, apparently, a lucrative financial planning business, in which Burley claims he was grossing $140K per year. Recall also that Burley says the typical spread for his wraps is between $200 and $400 per month, which he splits, along with the buyer’s deposit, 50-50 with his investors. For the sake of argument, lets assume Burley’s average monthly net for his houses is $150. From this it’s a simple matter to figure out that, not counting the buyer’s deposit money, Burley needs to own/manage (hereinafter I’ll just say “own”) at least 78 houses to match the yearly income he has given up.

Of course the number 78 makes the obviously dubious assumption that the homes are never vacant, and that Burley has zero business expenses. Say he leases a small office for $500/month, pays an additional $200/month in utilities, and hires a salaried office assistant for $18,000/year. That brings us to 93 houses. Add in a modest 4% vacancy rate, and we’re up to 97.

Burley claimed in 1997 that he owned 133 homes. I personally think it was probably somewhere between 90 and 100, but it’s difficult to be definitive, and combing the public record is tedious, so I’m willing to tentatively take him at his word. Nonetheless, Burley didn’t suddenly own 133 income-producing properties on January 1st, 1991. He had to build up a portfolio over time. Below is a count of homes I could confirm he owned by the end of each year listed:

1990 – 5 (monthly income: $750)

1991 – 13 (monthly income: $1950)

1992 – 23 (monthly income: $3450)

1993 – 25 (monthly income: $3750)

1994 – 47 (monthly income: $7050)

1995 – 57 (monthly income: $8550)

If we assume that I’ve missed, say, 20 properties along the way, that brings us to 77 houses—just under the bare minimum needed to bring Burley back to his 1990 financial planner’s income (I shouldn’t have to point out again that I’m assuming no business expenses, here).

Is it any wonder, then, that Burley sought, in the meantime, to build a cult of personality and become the “real estate guru” that he is today, thereby supplementing what can only be construed as a meager business income with a comparatively more lucrative take selling $5,000 seats at seminars, $100 “wealth manuals,” and $300 tape sets?

John Burley's ROI Redux

John Burley makes a point to frequently tout the “Level 5 Active Investor” rates of return he and his successful students get on their “investments”—and how you can do it, too, once you’ve learned the “secrets.” I’m sure Burley, being the consummate slick sales guy, recognizes that, along with the promise of “financial freedom,” his claim that his “cash flow” technique consistently provides “20-100%+ returns” is his most alluring siren song.

I have grappled with Burley’s return on investment (ROI) claims from a more theoretical perspective in prior posts. I’m fairly confident that my analyses were persuasive and comprehensive. However, Burleyists could still use my focus on the abstract to their rhetorical advantage, saying, “Psychobabble! Einzige’s theories are all well and good, but the real-world success of John Burley and his students clearly refutes them.” If you go by what Burley and his students tell you then, yes, they might have a point. But you’re not going to get the whole story by going through Burley’s promotional materials, reading the mastermind forums, watching the videos from Progressive Profits, or, I suspect, even attending Burley’s expensive weeklong Boot Camp. Something tells me that Burley isn’t likely to be making his tax records available any time soon, either. What we’re left to work with, then, isn’t much more than theory and conjecture.

On the other hand, there is one thing we do have: the public record. We can use that, plus some theory and educated guessing, I believe, to shed more light on an area that Burley would undoubtedly prefer stayed shrouded in darkness.

Burley himself provides us with an excellent starting point on pages 379 to 388 of his book, where, in the process of going over his “cash flow strategy,” he gives concrete examples of actual properties his company has managed over the years. Burley stresses to his readers that the homes he highlights were “not special deals… I selected these for illustration because they are very typical…” Fortunately for us, he gives just enough information about each property to make the relevant documents easy to find in the online database of the Maricopa County Recorders Office.

Here is one of his examples:

3320 W San MiguelFollow the links to the recorded documents I’ve provided in the above quote and you’ll find that the public record bears out Burley’s dates and dollar figures. However, in detailing this example, Burley has engaged in significant distortions and withheld pertinent information. In no particular order, these include:

I acquired this property in May 1998. It is a typical ‘Lunch Pail Joe’ house. Built in 1958, it is a 110 square meter, 3-bedroom, 2-bathroom house. It had a swimming pool which required replastering (responsibility of the new buyer). The inside and exterior had just been painted by the lender.

It was a lender foreclosed property. The purchase price was $58,513 with monthly payments of $431 (PITI). I took out a 90% loan at 7.2%. My deposit plus settlement costs came to $7,549.

I remarketed the property 16 days later for $74,900 with monthly payments of $756. I collected a deposit of $3656. This gave me a contract profit of $16,387 and a monthly profit $324; 30 years at $324 a month equals $116,740 of passive (positive) Cash Flow.

Let’s take a look at the first year cash-on-cash return on this property. We do this by dividing our initial investment capital into the first year’s income. The initial investment capital was $7549 divided into $3,656 deposit plus $3,891 received as 12 monthly payments of $324 from the new buyer. This is $7,549 divided by $7,547 = 99% [sic] first year cash-on-cash return.

Investor Property

If you’ve looked at the linked documents, you’ve probably noticed that Burley didn’t really own this house. It was actually owned by one of Burley’s investor partners, John McCants. As Burley’s partner, it’s McCants’ job to put his name on all the paperwork, as well as put up all the front money and make the underlying mortgage payments. He then splits the profits with Burley 50-50. So, McCants supposedly gets, at best, an (admittedly not unimpressive) ROI of 45%, while, in effect, paying Burley an exorbitant 50% glorified property management fee. Of course, McCants also takes 100% of the hit when the buyer isn’t making payments, or when the property is sitting vacant—and that’s going to eat away at your ROI faster than alien blood eats through the bulkheads of the Nostromo.

But, anyway, let’s follow Burley’s example, and pretend John McCants is out of the picture, for now.

Amount of Deposit

As you can plainly see if you look at the Agreement For Sale, the actual deposit was $2,900. Burley is including the first month’s payment with it, effectively making his first “year” include a 13th month. Ironically he can’t even claim that, because his buyers were already in trouble by that time, and paid part of their 13th payment several weeks late. Admittedly, it may seem like quibbling to say the first year cash-on-cash from this deal was “only” 90%, versus 99%, and it might be—if we were talking about someone other than John Burley. Trust me. It’s all downhill from here.

“Contract Profit”

The $16,387—the difference between Burley’s purchase price and his sales price—is made up money. As the term “contract profit” implies, Burley (and McCants) hasn’t actually been paid this money. Instead, what he actually has is a promissory note. If the buyer defaults, any unpaid portion of the balance simply evaporates (and, obviously, so do the profits).

“30 Years”

Burley repeats this one a lot. He loves to give his “students” the impression that, once the buyer signs on the dotted line, no more work will be necessary, other than periodic trips from the mailbox to the bank to deposit the checks. The fact is that most people don’t live in one place longer than a few years—particularly when it’s their first home purchase. Such was the case with this very property. Burley’s buyers, who, as I’ve said, almost lost the house to foreclosure in August of 1999, sold it in October 2005.

Technically, if the house gets sold early, your ROI ends up actually being higher, for reasons I’ll go over in a moment. On the other hand, once the house is sold, you get no more checks. What happens then? Obviously you have to keep finding and buying and remarketing houses. You might be “your own boss” in such a situation, but I’d hardly call it “financial freedom.”

“$324/month for 360 months = $116,740”

Now, there’s no denying that 324 multiplied by 360 is equal to 116,740. However, things get a little more complicated when you start adding words like “dollar” and “month” to the mix.

I find this distortion particularly interesting. It may not constitute incontrovertible proof, but it is certainly very persuasive evidence that one of the following statements is true:

- John Burley doesn’t understand the time-value of money.

- John Burley thinks his students don’t understand the time-value of money, and he isn’t interested in teaching it to them.

Imagine Burley coming to you and offering to give you $324/mo. for 30 years (let’s call it a “promissory note”) if, in exchange, you pay him $116,740 today. Reading his quote above gives me the impression that he would see this as an equitable trade. Hopefully, though, you would recognize it as an appallingly bad deal for you. The question is: How much should you pay someone today in return for 360 monthly payments of $324?

To answer that question you need to know what your other options are (your “opportunity cost”). Where else can you put your money? What if you could choose between Burley’s promissory note and, say, a hypothetical security instrument that pays 6% per year? In that case, you might tell Mr. Burley that you’d be happy to pay him $54,310.68, and not a penny more. Burley, who has just spent $7,549 and taken out a loan for an additional $52,661, politely (and understandably) declines your offer. If Burley seriously wants someone to take his monthly payments, he must continue looking until he finds someone whose next best investment opportunity would pay a maximum of 5.058% interest per year (In actuality it’s worse than that because with Burley’s note there’s a significant risk of default. Note buyers would thus calculate in some discount rate to compensate).

Please note that none of the above illustration is meant to conflate the ROI of the note purchaser with Burley’s cash-on-cash return on his wrap. The ability to use leverage (i.e., OPM) is one of the more attractive aspects of real estate investment. The point I’m making is that Burley is, at best, painting an overly rosy picture (come to think of it, that seems to always be the point I’m making with respect to John Burley!).

Pertinent Costs not included in “Initial Investment”

In keeping with the “overly rosy” theme, Burley fails to include a number of material expenses in his “initial investment” figure. Why doesn’t he mention his staff costs (pro-rated, of course)? Why doesn’t he include his office overhead (again, pro-rated)? Why not the property’s advertising costs? What about its acquisition costs? The house didn’t just fall in Burley’s lap! What about the carrying costs incurred during the 16 days the house sat vacant? Burley includes none of these things in his $7549, yet all of them are real. All of them are significant. This is where I really start to wonder how dumb John Burley thinks his “students” are. Bring any of this stuff up, and you’re bound to hear “Psychobabble! Details don’t matter!” shouted at you, in response.

What about Burley’s time?

Making an accurate estimate of all of the costs I mention above is really an exercise in futility. Your guess is as good as mine. In contrast, determining the lower limit of the value of Burley’s time is a simple matter. We know that if Burley wasn’t being his Level Five Investor self, he’d be in California making upwards of $140,000 per year as a financial planner. We know Burley decided to walk away from this $67.31 per hour, which means he values his time even more than that, but lets stick with $67.31 since we’re sure his time is worth at least that. I think this $67.31/hour is a good proxy for Burley’s expenses, too. After all, you don’t hire staff and occupy an office to make yourself less efficient. All we’re left with, then, is guessing at how much time Burley and his organization spent to make this deal come together.

Was it a week? Then Burley’s ROI on 3320 W San Miguel drops to 66%. Two weeks? Now we’re down to 53%.

You might be looking at those numbers and thinking, “Those are still pretty respectable!” I guess then it’s time to remember that Burley is splitting the profits with an investor. It’s probably also time to remember that Burley’s buyers are necessarily people with bad money-management skills (if they weren’t, they could get a normal home loan like everybody else). Given the tendency of people with poor credit histories to not pay back the money they owe, I would hope that you’d look at the promise of a 26% ROI and see it as a barely acceptable risk premium. Not all properties are bundles of joy, like the San Miguel house. Some, like 2542 W Missouri Avenue, are the demon seed.

Another “Not Special Deal”: 2542 West Missouri Avenue

Purchased in a partnership with his investor Todd Severson on January 13th, 1992, for about $39,000 (based on the loan amount and guessing they put down 10 percent), this house was quickly remarketed to one Gwendolyn R. on the 22nd.

Ms. R’s down payment was almost certainly $1,900, and her monthly payment was $505. If you figure the underlying loan’s interest rate at about 8%, that means that Burley and his partner’s principle and interest payments were around $255/month. Add another $60/month for taxes and insurance, and Burley and his investor were each making roughly $95/month.

Using Burley math, what ROI does that translate to? Initial investment ($4040) divided by deposit plus first year net income ($4300) = 93%.

Everything seemed rosy for over a year and a half. But then, in August of 1993, Gwen missed a payment. In September she missed another one. Then another in October. In a fashion indicative of some measure of uncertainty (read “panic”), and uncharacteristic of his future behavior in this area, Burley sent Gwen two Notices of Forfeiture, the second one a copy of the first, except with additional scribblings to include mention of the missing October payment.

Kicking Gwen out, though, would prove more difficult than just mailing a couple letters. In November she sued Burley and pals, in an attempt to enjoin the forfeiture of her interest in the house. Of course, she was in arrears, and clearly in the wrong (legally, if nothing else), so her suit would only postpone the inevitable. But postponement sounds the death knell for investment returns. In this case it meant zero income from 2542 W Missouri from August 1993 until May 1994, when they were finally free of the lis pendens and found a new buyer. By all indications, this second buyer was trouble-free, living in the house for 5 years, then paying off the loan and, presumably, moving on to a new home.

Now, I ask you, why is it that Burley—a man who is purportedly interested in educating investors—doesn’t include the very educational horror story of 2542 W Missouri as one of the examples in his book? Could it be because Burley isn’t really interested in providing an education?

I leave it for you to decide.