An April 2005 boot camp attendee, I suspect ChavaRica is representative of the more typical Burleyist. You see, being wealthy is all about having a positive attitude, being a money attractant instead of a money repellant, and keepin' the dream alive!

This type of Burleyist “invests” all his money in boot camps, seminars, tape sets, books, etc., swallowing the dream that Burley - and his ilk - is all-too willing to feed them bait, hook, line, sinker, and pole - and doing it over and over again - even though that first deal and all that wealth just never seems to materialize.

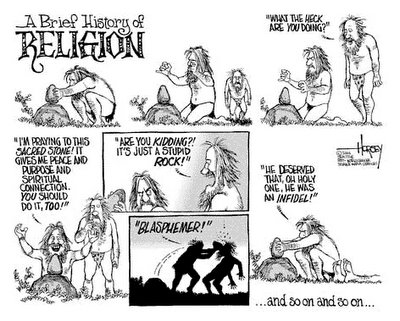

Like all religious fanatics, the Burleyist doesn't see this as evidence against the claims of his guru, but instead as some defect in the strength of his own faith in those claims.

Tuesday, March 28, 2006

The Burleyists - ChavaRica

Monday, March 27, 2006

John Burley's eBay Store

Fascinating.

Follow that link and it'll lead you to this site. Burley seems pretty damned busy for a guy "in a position to retire"!

End Prohibition (Again)

My friend Marc Victor, a criminal defense attorney, has written a nice article on why the drug war is stupid beyond belief (unless you happen to be a drug dealer or employed by the DEA - 'cause then it's awesome!).

Sunday, March 26, 2006

The Burleyists - Chris Bridgeman

From the October 2002 “Orange Platoon,” Chris Bridgeman, one of Burley’s New Zealand students, apparently stopped contributing to the Mastermind forums halfway through 2003. Could that be the point when he “left the rat race”?

Mr. Bridgeman is noteworthy because of the various organizations I’ve been able to find relating to him:

EZI Home Ltd.

Haven Property Group Ltd.

Foundation Investment Group Ltd.

A few observations:

- The EZI Home page doesn’t look like it’s been updated in 5 years.

- The Haven site is copyright 2004, but it links to another site with some additional property listings. Unfortunately, I don’t know how long they’ve been there. At the time of this writing there were 7 houses listed, 4 of those marked as “sold,” and 2 properties in Papakura, one with a “sunny aspect” (047DOM) and another described as a “weatherboard home” (016BEL). They claim to have sold over 70 houses, though.

- It seems that Chris Bridgeman is no longer affiliated with Haven, which might explain why Foundation Investments exists.

- Given the investor testimonials at Haven's site, I'd have to say that if you want real “passive income” you should consider being the investor rather than the Burleyist!

- The About Us page at Haven’s site doesn’t mention John Burley anywhere.

- The About Us page at Foundation, on the other hand, scares me a bit.

- Actually, the whole site scares me.

- My inquiry to the Foundation Investment Group several weeks ago went unanswered. Perhaps this was due to my not being in New Zealand, but still, what happened to common courtesy?

The Burleyists - Troy Mann

a.k.a. “Ka$hflow King”, “Kashflow King”

Troy Mann is interesting to me because I’ve seen him around the Rich Dad and Mastermind forums ever since I started looking at them, over 6 years ago. He seems to have gone to every seminar and purchased every course out there, making him the quintessential acolyte. Any criticism of his gurus is dismissed with a wave of the hand and an ad hominem (See, for example, here. It’s easy to find many more Troy Mann posts like that).

He’s also interesting because of the review found on this page:

…I had an experience recently that soured me on [Burley’s] organization. After investing with a individual whose testimonial is posted on his website (Troy Mann from Tulsa, Oklahoma) and having the investment go bad, I posted a message to John's forum asking if anyone else was having the same problem. Within 24 hours, the Burley group had the message pulled. I haven't heard anything from the Burley group since. It was as if they wanted to stick their head in the sand and make believe a problem doesn't exist. In the mean time, they still have Troy's testimonial posted on their website stating that his annual income for 2005 was $108K as of August 2005. The following month, I received an e-mail from Troy stating that he couldn't pay the interest and three months later, was claiming any payments of principle would force bankruptcy.With a little focused Googling, you find, among other things, his now defunct web page for his atrociously named company: http://www.cashflowrealty.net/. That link doesn’t work, but thanks to Google’s cache of the site, we can read what was on their “About Us” page:

Troy D. Mann began investing in real estate October 10, 2001. With no job, his life savings, and a burning desire to create a profitable business he became a full-time real estate investor. Starting out with four properties, Troy has increased the real estate portfolio of Mann & Associates dramatically. Due to hard work and financial competence Troy found himself in a position to retire at age 32.Note that the Burley Boot Camp testimonial mentioned by the reviewer above is not the one that I've linked to (which, curiously, doesn't actually have Troy's last name associated with it, unlike the majority of the other testimonials on the page!). It turns out that the review in question was removed from Burley’s web page. Sadly, I can’t find it in Google’s cache any more, either. However, I did manage to save it. Here it is:

Troy is the former vice president of Vision Investment Properties Real Estate Investment Association, the first nationally recognized real estate investment club in Oklahoma.

Before his investment career started Troy was a web developer. He worked for a dot com company, an electric company, a healthcare organization, and Dollar Rent A Car.

Troy has many friends from John Burley's real estate boot camp and is an active member on its popular discussion forum. He is a returning boot camp student instructor and has an honorable mention in the book “Powerful Changes”.

September 2005I leave it to you to decide whether Troy Mann is a successful real estate investor or not.

Anyone who is even thinking about Boot Camp should carefully consider the consequences of taking control of their career. After all the jobs in my degree field left the area due to globalization I was forced to work in the IT field for 50k and 60k a year. Getting laid off three times in a row, always during Christmas made me look for something better. Lets see what that looks like:

BS degree in Chemistry and Chemical Engineering

Cost: $40,000

Time to complete: 6 years (including graduate courses for an unfinished MS)

Entry Level Yearly Income: $50,000

Yearly Income with 5 years of experience: $85,000

Hours worked per week: 50

Wage per hour: approx $35.42

Return on investment: 50,000/40,000 = 125%

Burley Boot Camp

Cost: $5,000

Time to complete: 5 days

2005 Aug YTD retained earnings: $108,000

Hours worked per week: 20 to 50 at my choice

Wage per hour: approx $96.43

Return on investment = 108,000/5,000 = 2160%

The idea is to leverage your income by learning new skills. Although I am working less and making more than those lousy IT jobs paid there is a lot of improvement to be made. I am now redesigning my "job" to triple the income while working fewer hours. Getting leverage on your income is a fantastic skill. They dont teach this in the university environment. Without John Burley I would still be looking for another crummy position involving ridiculous schedules for some jerk who demanded me to put work before family.

Burley Boot Camp, just go.

Troy and Lori Mann

Tulsa, Oklahoma

Wednesday, March 22, 2006

Nihilist Assault Group

Last night I went with my friend Steve and his friend Chris to the 9:30 Club to see Stereolab. It was an enjoyable show.

I've been a big fan of theirs for years, in spite of their overt Marxism. Lately, though, their leftism hasn't bothered me as much. George Bush has done a lot to enable me to embrace my own inner leftist.

There's another aspect to this, too. Take a look at these lyrics:

What's morals after all?If you're familiar with the words of Max Stirner then I think you'll have to agree that this seems to be more than just a distant echo. On the other hand, I doubt seriously if Stereolab are even aware of Stirner. So what are we to make of this?

Set of rules from above

Moral panic calls for more censorship

While annihilating le perdure sens critique

Critique, Moral panic calls for more censorship

Morals are for the blind, not the critical mind

Morals which don't even tackle the real issues

Morals which seek intervention and control

Morals which don't even address the real problems

Morals that just seek control over our lives

In my own humble opinion it's a small confirmation of the controversial thesis that, as David Leopold says in his introduction to the Cambridge edition of The Ego and Its Own, Stirner was "central to the formation of Marxism," because he "[forced] Karl Marx to break with left Hegelian modes of thought" - in other words, to abandon his Feuerbachian humanism and develop his own "historical materialism."

Of Stirner's book, Engels himself said, in a letter to Marx, "...this work is important...the first point we find true is that, before doing whatever we will on behalf of some idea, we have first to make our cause personal, egoistic..." Marx, on some level, must have agreed with him, because the two of them wrote a refutation of Der Einzige that was longer than Stirner's own book!

There's no way we'll ever know for sure, but for my part, I like to think that Laetitia is channeling Stirner, even if Marx is playing a bit of an intermediary.

Sunday, March 19, 2006

The Burleyists - Mike Hay

Of all the Burleyists I've looked into so far, Mike Hay is perhaps the most interesting. Mostly because there's actual evidence that he is actively involved in the business of buying and selling residential property.

Take a look at what Mr. Hay has to say about John Burley on the Mastermind forum, in this post from November 26th, 2003:

I first was introduced to John Burley's methods when my partner went to the April 2002 bootcamp. At that time, we had 6 properties. Almost all were poor investments and learning experiences.... no money down, taking poor credit people out of foreclosure and re-selling to them, junky properties, and so on. Now, after one and a half years of listening, learning, working hard and believing in the system, we have 37 properties with a handful of others that have either been flipped or cashed out. And in five minutes, just a couple weeks after turning 30, I will be leaving my bene-filled corporate job that my parents and society have always taught me to aspire for. True financial freedom is probably a couple years out, but this day has been something that I have been working for for a long time. Thanks to all that have taught and supported me and I look forward to continuing to grow with this community.Now, there are a number of things in that post that I'd like to highlight. Note first the not trivial fact that he was already a fairly experienced real estate investor prior to his exposure to Burley.

He, like all Burleyists, makes a big deal about leaving the corporate world. But what is he leaving it to do, really? Burley and Kiyosaki give the impression that "leaving the rat race" means being able to jet off to Hawaii to sip Mai Tais while you're dozing in a lounge chair on the beach. That's the dream they sell (hinted at in the quote above where Mr. Hay says "true financial freedom"). The reality is, however - and this is also true for John Burley - that Mike Hay has become a business owner and entrepreneur. He may love the business of real estate and so consider that an improvement over being a wage slave, but that doesn't mean he's not going to encounter long work weeks, sleepless nights, and uncertainty. He has ended his responsibility to an employer and replaced it with new responsibilities - to his employees, partners, investors, and homebuyers. There is unquestionably an upside potential - but that's true in any entrepreneurial venture, not just real estate.

And what about the "true financial freedom" that, in 2003, Mr. Hay guessed was "probably a couple years out"? Well, I note he is still a fairly regular participant on the Burley forums, so my guess is he hasn't quite made it, yet. Another hint - and a sobering one, at that - is one I found by keeping tabs on the list of properties displayed at Easy Way Homes. For about 6 weeks, now, 20 properties - basically the entire inventory of houses they've had for sale while I've been watching - have sat unsold. I was beginning to think that the web site was defunct until yesterday I noticed a "SOLD" sign go up on one of them. Ouch. I guess Mr. Hay and his business partner need to go back and review that section of Burley's teachings where he shows "How To Build A Database of Eager Qualified Buyers Who Will Be Anxious To Move Into Your Properties." Print up some more door hangers, guys!

Saturday, March 18, 2006

The Burleyists

John R. Burley’s printed “Advanced Investing Boot Camp” promotional brochure, which he will send to you if you enter your mailing information at his web site, makes a number of unbelievable claims. For example, he calls this $5000 boot camp—for which he undoubtedly grosses a minimum $350K per year—an “act of love.” Riiiiight. He also says:

Once upon a time (actually a few years ago) I ran the number one Real Estate training in America. Each month thousands of people would pay $5-7,500 to take my training. Our success rate (based on the number of students making money) was the greatest in the history of the industry.All I can say is, “Whew!” There is an awful lot to parse in those three compact sentences!

So, Burley was training “thousands” each month? Does that sound even remotely realistic to you? What exactly does that mean? Let’s call it 2000/mo. at $5K a head. That brings gross receipts to $120 million per year. I suppose that would definitely qualify it for “number one” status (an otherwise completely vacuous statement—by what standard were these trainings “number one”?). Clearly, though, this claim is entirely bullshit. How many people—let alone real estate gurus—made $100 million a year in the US in the early ‘90s? Not many. Why isn’t Burley as famous as Kiyosaki (who I’m sure has never made that kind of money), or Trump, or Howard Stern?

And where are these 24,000+ students now? Do you think it likely that a person who teaches 24,000 people to become wealthy would remain almost unknown? What is their “success rate,” anyway? How does Burley know how many students are “making money”? Does he look at their tax returns? How does Burley also know the success rate of the students of all the other gurus? He doesn’t, because it’s not even likely that any of the other gurus know what it is for their own students. Another bullshit claim.

But really, who are John Burley’s students? What are they like? Are they really successful? For obvious reasons this is a very difficult question to answer definitively. However, a little time spent on the Mastermind forums yields interesting results, especially if followed up with some Googling.

The first thing you’ll note is that many claim to have had their “lives changed” after attending a boot camp, and on those rare occasions where someone posts something skeptical or negative at the Burley forums, many will immediately defend Burley with an enthusiasm on a par with a religious fervor. You might notice that the resemblance to religion doesn’t stop there. A lot of the phraseology and arguments also strike a religious chord, which is why I’ve chosen to call these acolytes “Burleyists.”

I’ll take a close look at some of them individually in upcoming posts.

Wednesday, March 08, 2006

John Burley's Investment Returns

…or: Why Economists Make Poor Entrepreneurs

John Burley declares, at every opportunity, that he routinely gets investment returns of 40%, 50%, or more on his wrapped properties, and “with little risk.” Specifically, he tells his investor partners that he is aiming for (but of course doesn’t guarantee) a minimum first year return on investment for them of 50%—or that’s what he was telling them when he recorded Blue Print for Success back in the mid-90s. I can’t be sure what he is saying now.

However, given that the average return on investment (ROI) in the stock market has historically been around 11%, I don’t believe Burley’s claims are credible—over the longer term, anyway. An explanation of why requires delving into a little economic theory known as the efficient markets hypothesis—or, as Burley might call it, “Psychobabble.”

Of Grocery Store Lines and Freeways

It’s an early Saturday afternoon, and you—and everyone else, it seems—are at the grocery store. When your basket is full and you’re ready to leave, which line should you pick? The fastest, right? Which one is that? As you take the time to figure it out, you notice that other people keep getting into the lines ahead of you, and they all seem to be roughly the same length.

After you finally make it out of the store and you’re driving home on the multi-lane freeway in stop-and-go traffic, you notice the next lane over seems to be moving faster than yours. As soon as you see an opening, you take it. Your victory is short-lived, though. Soon your new lane comes to a stop. You watch in dismay as the car that was behind you in the other lane now zips past you.

Economics 101

The above over-simplified examples serve as intuitive and familiar illustrations of the concept of the “efficiency” of competitive markets (for a more detailed discussion of the above examples, go here to read their source). Stated less colorfully, but in a way that is more relevant to discussing John Burley, the basic idea is this: In a competitive marketplace, where all economic actors have basically the same goals and roughly the same information, excessive profits will be very unlikely.

That’s a bold statement (pun intended), and also rather abstract. Let’s define some of the terms and hopefully make it clearer.

Competitive Marketplace – In this case, I mean Maricopa County’s residential property market, and specifically the market for home buyers who have a poor credit history. Is this market competitive? I can’t speak for what it was like in the early 1990s, but a quick search through the real estate classifieds at http://www.azcentral.com/, using keywords such as “low down,” “ez qual,” “no bank qual,” “bad cred,” etc., ought to at least give you pause. If he ever was, Burley is clearly no longer the only game in town.

Economic Actors – By this I mean all the buyers and sellers of single-family homes in Maricopa County—and mostly I mean the Investors.

Same Goals – Investors are interested in getting the highest ROI. Sellers are interested in getting the highest price for their property. Buyers are interested in buying the nicest house that they can afford.

Same Information – All the economic actors know (or should have at least a basic understanding of) what home prices, rents, interest rates, etc., are doing. None of the economic actors can see the future. None has secret knowledge that is unavailable to the rest—at least not on a consistent basis.

Excessive Profits – I am not using the word “excessive” in a normative sense, here. In a free market, high profits serve an extremely useful social function: They are a signal or a guide to entrepreneurs about where there exists unmet consumer demand. Profits attract investment dollars to where they are needed most, as defined by the consuming public. In a very real sense, consumers vote for the best entrepreneurs with the dollars they spend. So here I am defining the word “excessive” as simply “higher than around 11%,” since that has been the long-term historical average ROI of the stock market.

The Hypothesis Expanded

So, now we’re in a better position to explore why it is that John Burley is almost certainly, um, let’s say, “stretching the truth” when he claims he regularly gets 50%, or higher, ROI with his wraps.

Burley would like to buy an investment property for as cheaply as he can get it. Unfortunately for him, the state isn't going to give him a monopoly on the Phoenix housing market, so he can't just name his price and expect all sellers to just roll over and take it. He is competing with all other homebuyers in the market. That includes other investors, out for a bargain purchase, and “retail” homebuyers, who aren’t necessarily looking for a bargain so much as looking for a home that they will enjoy living in. Thus, the retail purchaser will usually be in a position to outbid the investors for a given home, assuming 1) that the home doesn’t have some hidden serious defect, or 2) the investor(s) didn’t find out about the property before the retail buyer even had a chance to bid.

Unless Burley can come up with some ingenious ways around the above problems—ways that he can keep secret from all the other buyers, so that they can’t also use them—he is going to have to deal with buying homes usually at a higher price than he would want, and expend time and money searching for longer than he would want, both of which negatively affect his ROI. On Blue Print for Success, his only advice is to “make lots of lowball offers” until you get lucky and some dumb/desperate seller accepts. Is this a “costless” strategy, do you think?

Once Burley finally gets lucky and buys an investment property he’s up against a different set of problems. He’d like to sell his place for as much as possible, but he can’t ask too much, because then his house will sit vacant as buyers go elsewhere. Other investors are as motivated as he is to attract the finite set of homebuyers, and this process of attraction costs money—either in terms of advertising costs, repair, maintenance, or upgrade costs, or an attractive purchase price or terms—all of which, again, negatively affects Burley’s ROI.

As the number of investors rises in a given market, the competition for the same resources (meaning properties and buyers) increases. John Burley, just like the rest of the investors, then faces a choice: lower your expected ROI, to compete, or suffer losses from properties sitting unsold. Over time, this forces the average ROI of all investors down to a level where they are basically doing something a little better than 11%. Those investors who don’t meet that ROI either go broke or decide (wisely) that their money would serve them better if, instead of using it to wrap houses, they put it in, e.g., an index mutual fund.

Now, admittedly, this analysis is still a bit simplistic, but the burden of proof is on John Burley to show that he really is getting consistently “excessive” returns (and then to show how he’s doing it, since he claims to be providing “the highest quality real estate investment, wealth-building, and debt-free lifestyle information”). Of course the irony is that as soon as he’s revealed it, nothing precludes his competition from adopting his techniques and putting them to use against him. That might go a long way toward explaining why he’s so fond of yelling “Psychobabble!” when people ask him “How?”

As you probably know, I’ve been looking at Burley's public record. I hope, therefore, that I’ll be able, in an upcoming post, to take a close look at one or two of Burley’s investment properties and get at least some rough approximation of their actual ROIs. Stay tuned.

Saturday, February 25, 2006

John R Burley's Investment Properties

Are we to believe John Burley's claims about himself - that he, as he is so fond of saying, “walks his talk”?

Back in 1997, while in Australia with Kiyosaki, Burley claimed, “I have 133 houses right now that pay me an infinite rate of return.” His promotional materials variously tout that he has done anywhere from 600 to 1000 “completed transactions.” As a skeptic, my first reaction is, “Yeah? Prove it!” Since Burley clearly has no intention to back up his claims with verifiable evidence, I took it upon myself to do a little investigation of the public record and then share what I found. I have to admit that I am a little surprised at the results.

Now, one could take issue with Burley’s usage of the word “have,” since many of the properties I found don't actually seem to be owned by him - and what the hell should we credulous fools consider a “transaction”? Buying a pack of gum at the Circle K? Also, his bragging about an “infinite rate of return” is no doubt calculated to really impress the neophyte investors in his audience, but when you think about it, it’s a meaningless claim. For example, I’ve got a job that pays me an infinite rate of return. Whoop-tee doo! And Burley’s claim that he doesn’t consider Burley & Associates to be a job rings very hollow to me. Managing 100+ glorified rental properties may be lucrative, but it can’t be a cakewalk.

But I guess it’s ultimately fruitless to be quibbling over semantics. In compiling the list below, which is as complete as I could make it (for the time being) I discovered that, in fact, the rabbit hole goes very deep. Indeed, one may never be certain to have found the bottom.

If you are seriously considering sinking $5K into a Burley “Boot Camp,” you might want to take a peek down that rabbit hole for yourself. I’m sure you’ll arrive in Phoenix armed with endless lists of questions—all of which will probably be shouted down as verboten “Psychobabble!”

The people named are what John Burley describes as “Investor Partners.” Below their names are the Burley investment properties I have so far been able to find associated with them.

Adrian Barrow

2413 W San Miguel Ave.

4824 N 81st Dr.

5635 N 62nd Ave.

6336 N 40th Dr.

5037 W Cambridge Ave.

Bill Burley aka William E Burley

Is Shari L. Burley married to two people, or are John and William Burley the same person? That is a very odd document.

3023 N 57th Ln.

6844 W Windsor – Why was William Burley about to be foreclosed on?

7003 W Verde Ln.

Bill Tyma aka William Tyma

4843 N 80th Dr.

6727 W Mariposa Ave.

Charles Y Norris

6232 W Keim Dr.

Mr. Norris appears to have a lot of recorded documents that seem unrelated to investing with John Burley, or even using his methods, though they do seem related to real estate investments.

Christian Cluff

8239 W Earll Dr.

8406 W Glenrosa

37244 Walnut St.

Donald Burley

1110 W Glenrosa

6980 W Wolf Rd.

Folded into the Little Girls LP.

Donald and Debra Quinn

7340 W Heather Brae

Frank Batmale

2935 N 40th Ave.

Folded into Old Southwest LP in 1996.

Gloria Iorio

Gloria is the one investor I've found who actually recorded her joint-venture agreement with Burley.

8812 N 36th Dr.

Folded into Bubba’s Treasure Chest LP in 1996.

James J Mullaney

6501 W Clarendon Ave.

Joan Kaufman

5735 N 32nd Ave.

7750 W Windsor Blvd.

John McCants

3308 N 62nd Dr.

3320 W San Miguel

5448 W Northview

5526 N 68th Dr.

8820 N 8th St. #204

11444 N 21st Dr.

13238 W McClellan

Mark Hoose

4440 N 49th Ave.

5420 W Mulberry Dr.

Michael Rossum

5936 W Monte Vista Rd.

6726 W Palm Ln.

8402 W El Caminito Dr.

Monte Bosch

Many of Monte Bosch’s later properties are apparently not managed by John Burley or Burley & Associates. It appears that Dr. Bosch—a dentist in Sun City, by all appearances—was an excellent learner and decided he could go it alone. As such, a few of these properties are not associated with John Burley. Dr. Bosch has a number of others that I have chosen not to list.

1515 W Grovers Ave.

2473 E John Cabot Rd.

2801 N 69th Dr.

3638 N 88th Ln.

4206 N 109th Dr.

4625 W Sheridan St.

4627 N 82nd Ln.

5474 W Osborn Rd.

6346 W Ocotillo Rd.

6517 N 61st Dr.

7245 W Brown St.

7402 W Becker Ln.

8019 W Campbell Ave.

8443 W Roma Ave.

Richard K Cottrell

8123 W Indianola Ave.

Robert E Aikman

3806 N 72nd Ln.

Robert Kiyosaki

Yes, this is the Robert Kiyosaki, of Rich Dad fame.

13237 W McClellan

6916 W Virginia

Shari Burley, No Investor, or Investor Unknown

I’m pretty sure this is an incomplete list. I still have more than a dozen or so documents to comb through.

2202 N 84th Ave.

2476 E Cactus Rd. – This must have been one of Burley’s earliest deals. Look at this contract!

3439 W Michigan Ave.

6928 W Pierson St. – Another very early one.

7027 W Kimberly Way – This is Burley’s home, actually.

822 E Carol

3844 W Caribbean Lane – This may be the very first property that John Burley purchased in the Phoenix area, althought title company records differ significantly from the records in the Maricopa county recorders office. According to Transnation Title, the house was purchased on March 1st, 1989, for $60K (loan $55.5K). County records, on the other hand, seem to indicate that the property was purchased in November 1991 by Shari Burley. What is perhaps even more interesting, though, is that Burley lists the house as "sold" on his ez2own1.com web page, even though he just recently borrowed $148K against it, and I can find no documentary evidence that this place has ever been one of Burley's "wrapped" houses.

Sukan Makmuri

7274 W Highland Rd.

10625 W Turney Ave.

Thomas E Bartlett

11377 N 113th Ave.

3632 N 88th Dr.

6801 W Windsor

7023 W Highland Ave.

7802 W Minnezona Ave.

Thomas Bartlett has several other properties described in the recorded docs, but I’m not sure they are investment properties.

Todd O Severson

2542 W Missouri Ave.

John Burley began transferring properties into Nevada Limited Partnerships, under the GP umbrella of the Southwestern Endowment Fund, in 1996, and this process accelerated in 1998, as Burley’s legal entities proliferated. At that point, Burley’s contracts became more sophisticated and allowed for more privacy, making the finding of Burley houses difficult or impossible. The list above, as a result, is not a complete list of all the properties I have found and am still finding as I search the public record.

Rather than list all the couple dozens or so properties here individually (frankly, I've already spent way too much time on this post - my friends are starting to call me "obsessed"), below I've posted links to all the related recorded documentation I could find. I invite you to explore on your own from here.

Southwestern Endowment Fund

Bubba's Treasure Chest

Corumn

Maxwell

Old Southwestern

Wabo Cabo

Tuesday, February 21, 2006

Skeptical Info on John Burley

If you came here via any of the search engines looking for in-depth reviews of John Burley and his products, I recommend you go first to the index to my John Burley Posts.

The main reason I have written so many posts critical of John Burley is because there isn't a whole lot of skeptical information specifically about him on the web, and often what is there is itself not credible.

My own web searches, however, did uncover a couple pretty good ones, like this page, as well as this one. It seems as though Burley's release of Progressive Profits puts to rest any question regarding whether he cares to maintain a good reputation. The product is so obvious an example of bait & switch, after all.

For more general thoughts on real estate investment, I highly recommend John T Reed, as well as the Searchlight Crusade. You'll learn far more from reading what's on those pages than you ever will from the likes of John Burley.

But, again, if you're looking for lots of information on John Burley specifically, check out all my posts!

Sunday, February 19, 2006

John Burley: Guru or Predator?

Some introductory remarks if you please.

A Quick Study in Contrasts

As a part of my dissection of John Burley, I considering borrowing liberally from John T. Reed’s B.S. detection checklist and then going through Burley’s web page and other materials with an eye toward where Burley rates, but then I thought, “Reed’s already done the work, so why repeat it unnecessarily?” Instead, I strongly suggest you give Reed’s checklist a look while you simultaneously peruse Burley’s page.

You may think that perhaps Reed is being too unforgiving, since, after all, Burley’s just out to sell his products with the most effective sales techniques available, right? I mean who is going to buy a product called Well-Known Real Estate Techniques That Are Extremely Risky and Excruciatingly Difficult? There is something to be said for that, but I invite you to spend some time taking a look around John Schaub’s page, for some contrast. While you’re there, ask yourself “Who is the more credible? Who seems more intent on creating a cult of personality and who on educating investors? Which guy evokes in me the word smarmy?”

The Secrets of Professional Investors Made Easy

In a fit of disgust, I threw away my Blue Print For Success and Wrap Your Way To Wealth tape sets some time back around 2002. I now regret having done that, because they would have provided me with a ton of material for these posts. As disappointing as that is to me, I have no interest in lining Burley’s pockets any more than I already have, so there’s no way I’m going to buy them from him (or any of the countless other “wealth training” sites out there) again. On the other hand, I have no objection to spending $15 on eBay to buy a used copy of The Secrets of Professional Investors Made Easy, a recording of a 3-day seminar in 1997 given in Australia by Robert Kiyosaki and John Burley, among others, in front of about 40 people, who each paid $3000AU for their seats. Not surprisingly, this tape set contains plenty of fodder for discussion (and that doesn’t even include Kiyosaki’s rambling tirades on the thing).

On the first day of the seminar Burley introduces and describes his conception of the 6 levels of investors (since updated to 7 levels, and available for free from his web page (.PDF) in a form that is arguably more substantial than what was presented at the expensive seminar). Following the descriptions of the levels of investors, Burley gives his formula for “Automatic Wealth” (also available from his web page for free (.PDF)), summarized here:

The 7 Habits of the “Level 4” InvestorWhile describing the above habits, Burley makes this asinine statement: “It’s so simple and easy to become wealthy that most people never do.” Is that supposed to be an attempt to sound profound?

- Paying Yourself First

- Re-investing Your Investment Returns

- Invest in Index Mutual Funds as a base to start

- Know What Your Money is Doing

- The “No Budget Budget”

- Financial Competence (Intelligence and Responsibility)

- Be Debt-free

I recommend you read the reports. They’re not entirely without content, and at least then you’ll know what “level 4” and a “level 5” investors are (and he uses those terms a lot). On the other hand, you’ll probably agree that these reports should be given away for free. They really don’t amount to anything more than you might get out of books like The Richest Man in Babylon (a far better book than RDPD, by the way, because, for one thing, it doesn’t pretend to be something it’s not) and More Wealth Without Risk. Had I been an attendee at the Secrets seminar, though, I would have been more than a little upset at the amount of time spent on this material (which I’d say was about $200 worth—all to go over this stuff he’s giving away free).

“The How”…

Late on the second day, the seminar finally gets to the discussion of Burley’s wrap technique. Burley goes over some brief biographical background, such as that he left a $140,000/year financial planner’s job so he could move to the Phoenix area in 1990 and take advantage of the down real estate market. He then launches into this perfect example of what is wrong with John Burley:

I do a 5-day seminar that’s just real estate…essentially the first two days is spent with people [who are unwilling] to believe that what I do can be done. So we waste, in essence, two days of the program, because everybody has got to sit there and psychobabble and what they’re doing is, the whole time they’re going, “B.S.! B.S.!, B.S.!” and it’s always, “Maybe where you are but not where I am. We can’t do it here.”No! It doesn’t! If I were a seminar attendee I would have been thinking “Hey! I didn’t pay thousands of dollars to waste my time listening to vagaries and veiled insults to my intelligence.”

Okay? So if we’re going to do we-can’t-do-it-here, then instead of covering about a dozen ways that you can do it…we’ll get through maybe 1 or 2 of them. So this is up to you. So, in other words, the more you’re analytical and the more you question and the more you go through it and the more you need details the less you’re going to get. Does that make sense?

If you could pretend for a moment you’re 5th graders this would be much easier because adults are a pain in the butt when it comes to they gotta know every answer.With those explicit instructions that the audience voluntarily make themselves stupid while sitting there, Burley continues. He describes that, at least initially, his method of property acquisition was through VA auctions. Because the Phoenix market was so bad at that time, there were several hundred foreclosure properties available at auction every 2 weeks. They were being sold at 75% to 80%, on average, of construction costs, and the VA loans were fixed rate 30 years at 10%, which Burley says was the best rate at that time.

Following all that, he says, “Details don’t matter, you don’t need to write this down.” I agree that writing the details down would be worthless (especially for people in Australia, who don’t have access to VA foreclosure properties), but to say that details like that he was able to buy the properties at 80% of construction costs don’t matter is a bald-faced lie. I think there is little doubt that this fact, if true, played a large part in how Burley made his money. And it’s also an unusual circumstance that makes his example completely inapplicable to anyone in attendance at the seminar, and quite likely, almost everyone who subsequently listened to the tape set. Are you going to tell me that that doesn’t matter? Wouldn't someone interested in actually teaching a wealth-building technique at least make an attempt at giving an example that was relevant to his audience?

Just a minor detail is that I didn’t have any money. And since I didn’t have a job I couldn’t qualify for a loan… Would a 5th grader worry about that detail?No, but a 5th grader wouldn’t pay boatloads of money to listen to you prattle on, either.

The fact that he bought a house with no money and no ability to get a loan is a minor detail? Who is he kidding? Obviously he is out for some sort of effect, here, and my cynical side believes that his intent is to so confuse his audience that by the end of it they won’t be able to tell that they’ve been snowed. Not only that, but I think he's lying. He purchased his home in Glendale in 1990 for approximately $220,000, and title company records indicate that he borrowed that much. It isn't your average broke loser who could qualify for that kind of money--and 100% LTV--in 1990!

He goes on. For ease of example, Burley talks about buying a hypothetical $100K house. In the process of the hypothetical he emphasizes, again, “I didn’t have any money, right?” But, he then jarringly switches topics, jumps to the present, and claims he still can’t get a loan:

[Rhetorically:] Why would you give a loan to a multimillionaire who has no debt and excessive income? They won’t because I have “too much real estate.”What does that have to do with when he was starting out? And how could he have not had any money when, just prior to moving to AZ, he was making $140,000 per year in California? Wasn’t he taking care of fundamentals? In this program Burley and Kiyosaki counsel against starting “level 5” investing without first making sure your financial house is in order and becoming a solid “level 4” investor via the “7 Habits.” Did Burley ignore his own advice?

The fact that the difference between what I owe on the real estate and what it’s worth is millions and millions of dollars [is irrelevant]. The bank says I’m a bad risk because the banker thinks an investment property is not an asset. He considers it a liability. That’s why bankers are poor and investors are rich.So the banker considers the home you live in to be an asset (and you and Kiyosaki claim it’s actually a liability) but he considers your investment property a liability? Having applied for (and received) many real estate loans myself, I know for a fact this is bullshit. They consider your property plus any rental contract you have (minus a discount for future vacancies) an asset, and your mortgage on it a liability.

My guess here is that no bank will lend to him because he can’t show them any of his documentation—all of it will clearly show that he ignores the due on sale clauses in the loan contracts. Why would a bank want to deal with a borrower who isn’t going to abide by the agreement? In addition, because it will be obvious that Burley does not intend to occupy the property, any loan he will get will have a comparatively higher interest rate, affecting his monthly spread and thus his return on investment (more on that later). [Update: Not surprisingly, it turns out that Burley is lying about all this, and he actually can get a bank loan. Imagine that!]

Having spewed that irrelevant tirade, he jumps immediately back to the “details” of his hypothetical home purchase:

Purchase price $100K PITI: $750/mo. IR 8%Why doesn’t that matter? How in the hell can he possibly get away with saying that it doesn’t matter? Only at a Kiyosaki seminar, where, for the past day and a half, RK has been rambling on about how he knows all and anyone who disagrees with him is a fool or a liar.

So, those are your details. That’s what you get. Now, I don’t have any money for this and the bank won’t give me a loan. Does that matter? No.

Next, and almost without pausing after saying the quote above, Burley says:

One thing you’ve got to understand about real estate—I’ve talked to a couple of you here that are familiar with commercial real estate—do you know on commercial real estate, like this hotel—you know this hotel was bought with no money down? Do you know that they probably got somewhere between a 25 to a 50 year loan? Do you know that they got below market interest? Commercial real estate is essentially always traded with no money down. It’s usually sold with vendor financing, meaning the seller financed it, or in a combination with the lender. Do you guys know that?I have no experience with commercial real estate, but even if it is true, how is it relevant to residential property loans and the example house that he started talking about? Rather than simply get right to his point (which is that investors should always try to get the seller to finance the property directly, because its easier to negotiate favorable terms), he seems to be engaging in deliberate obfuscation, here—more confusing switching of topics to distract the mind from the building questions. You almost have to admire the artistry.

This stuff about houses where you’re supposed to put these large down payments down and pay higher than real interest rate is a crock that you’ve been sold by the banking industry, because people in commercial real estate won’t do it.How is that? Just because the commercial real estate market is one way (he claims), it does not follow that the residential market is the same. Obviously they are not the same, and how the commercial market operates bears not a whit on how the residential market works. When you, as an investor in single-family homes, need to borrow money, you do it on terms that the lenders are offering, and since they are competing for borrowers you’re going to be getting a competitive rate and terms, based in the market and your credit-worthiness. Where is the “crock”? He implies that borrowers are being lied to, and he then fails to explain its relevance:

So, I’ve got a house, now. And I had to bring in an investor because I didn’t have any money, right? So, I brought Robert in, and Robert put down 10% [While this specific example is undoubtedly a hypothetical, it turns out that Robert Kiyosaki is in fact one of Burley's investor partners. See here for more detail on that.]One would hope that it’s at least that! You’d have to be a pretty worthless investor to pay $100K for something that isn’t worth at least that. And notice that finally we’ve got a deeply unsatisfying hint about how you can buy a house when you don’t have a job and/or can’t get a loan: get someone else to pay for it. Now there’s a “minor detail,” alright! I’m sure everyone in attendance and all the listeners of this tape set are going to be able to run right out and attract investment capital like a magnet!

So I’ve got a 90K loan, my payments are $750, my interest is 8%. And believe it or not the house, give or take, is worth 90 to 100 thousand dollars.

See, because there’s two ways you can buy real estate—you can buy real estate for price or for payments… So most people think the only way to make money in real estate is to buy it cheap and sell it high, right? Wrong. That’s the hardest way to make money in real estate, because everybody wants full price. Who would want to sell their real estate for less than it’s worth?By the way, this rhetorical question goes directly counter to his advice in the other tape sets to always offer a maximum of 70% to 80% on the market value of a property you’re interested in buying. So, obviously he thinks someone would “want to sell their real estate for less than it’s worth,” or else why would he counsel to offer less?

So I’ll buy it for market as long as I can get a good monthly payment for it. Because all I care about at this point in my life is cash flow. I don’t care about cash. The last thing I’d want to do would be to buy this thing for $70,000 and then turn around and sell it for $100,000, because now I’ve got $30,000 more dollars that I have to invest again that’s just sitting there. And it bothers me when the money sits there. It’s supposed to be working.Is he stoned? In what universe is it a bad thing to make $30,000 on a transaction? Besides, who says this can’t just be translated into a bigger spread for the “wrap”? This seems to be more obfuscation intended to get the minds of the people in the audience reeling, so that he can then yell “Psychobabble!” at them when they ask for clarification of details.

We take the house and “repackage” it. Sell it for $130,000. So the buyer puts $5000 down, and a gets a loan for $125,000. The average person buying a house or a car cares about two things only: How much to get in, and how much per month. Buyer’s payment will be $1150 per month. IR: 10%. The money is made on the spread.Of course he doesn’t explain how or why a person would be willing to pay $125K for a house that’s only worth $100K, but obviously his buyers are going to be people who can’t buy a house because of serious credit problems.

Now, imagine for a moment that you're a new McDonald's franchisee. You've just payed thousands of dollars for the privilege of getting in on Ray Kroc's secret recipe for running a profitable hamburger joint. He looks you in the eye, leans in close, and says in a low voice, “Spend a dollar on a burger, then sell it for two!”, after which he promptly stands tall and smiles smugly, as if he's just given you The Keys to the Vault.

You look at him, confused, and ask, "How? How do you make the burgers so cheaply?"

A scowl comes across his face. He screams “Psychobabble!” at you, and then says:

Most of my successful students don’t have any money. And they decided for once in their life they were going to stop going How? How? How?—because it’s just a crock! They decided they’d make some money for once.Implicit message: “If you want to ask me how, that must mean that you aren’t really interested in making money, you're not going to be like my successful students, and thus your being here today is a fraud.”

Having heard that, do you feel confident that your restaurant is bound for success? If Ray Kroc doesn't get a pass, then why should John Burley?

After endless hand-waving and insults hurled at the audience, Burley gives somewhat of an answer to the question of how he can buy a house without any money or ability to qualify for a loan: “An investor puts the money up, I put up the system.” Burley and the investor split the Buyer’s down payment and the monthly income generated from the spread 50-50.

The least important thing is the money because I can get money from anywhere. The idea is important.He said earlier that when he was starting out he didn’t have a clue what he was doing, so how in the world is a “broke” and “jobless” guy with an apparently unproven and half-conceived idea going to attract investment capital? If what he’s claiming is true, then he’s obviously not telling the whole story.

To attempt to get a better picture of the real story, I plan on delving deeply into the public records in my next Burley post. Go here for it.

Saturday, February 18, 2006

Some Brief Remarks About John Burley

Before I launch into full-on analyses of John Burley, his claims, and his teachings, I think some introductory remarks are in order (and they'll hopefully clarify - at least a little - the purpose of those long lists in the previous two posts).

I first became aware of John Burley, I believe, in early 2000, via a Robert Kiyosaki tape set I bought, called Financial Literacy. Burley was one of the featured speakers on the set, and he talked for roughly an hour about how he had become fabulously wealthy "wrapping" single-family homes in Phoenix, AZ.

Briefly, a "wrap" (also called a "lease option," or a "land contract") consists of buying a home and then selling it to a buyer who, for whatever reason, can't qualify for traditional financing, and so is willing to pay a premium to the investor, in the form of a higher purchase price and a higher interest rate. John T. Reed looks on these deals very poorly (see here and here), and I mostly agree with him--but I'm getting ahead of myself.

As someone who, at the time, owned two rental properties, I was immediately struck by this idea, because it seemed to provide all the benefits of rentals, with none of the downside. Of course, the hour-long discussion of the technique in Financial Literacy left out many significant details, and I wanted to learn more, so I went in search of what information there was available. It didn't take me long to find Burley's tape set Blue Print for Success, and plunk down $300 for it.

Sadly, the "course" didn't answer all of my questions, and whenever Burley would gloss over pertinent details and a member of the audience would call him on it he would simply say, "Psychobabble!" and that would be that.

Even though a very clear pattern was emerging (a pattern begun back in early 1998 with Rich Dad Poor Dad, actually), I decided I would pick up Joe Arlt's "Wrap Your Way to Wealth," which seemed a steal at "only" $149, and promised to be "very detailed" and done by a guy who claimed to be a "boot camp" attendee who was initially skeptical of Burley's techniques. It almost goes without saying that Arlt's tape set didn't offer any significant additional information, either (as an aside, I find it interesting that although I was easily able to find evidence that Burley does indeed seem to buy and sell houses in Phoenix, I have found zero such evidence in Virginia for Joe Arlt, even though he claims to "own and manage" over 400 houses. It's also a bit of a mystery to me that Arlt's tape set is no longer offered on Burley's web page, and Arlt is no longer a regular contributor to the discussions over at the Mastermind Forums. Hmmmm...).

So, in upcoming posts, I'm going to be looking in detail at what John Burley sells, what he says, and then I'll take a stab at how that compares to what he really does--or at least that part of what he does that can be more readily gleaned from the public records. I think also that I'll take a quick look at 1 or 2 of his more successful students, along the way.

Go here for the next post in the series.

Friday, February 17, 2006

John Burley's Legal Entities

Here is a list of all of the documents I could find on file at the Arizona Corporation Commission relating to John Burley or to Burley and Associates. Note that some of these are likely to refer to someone other than John R Burley. As I find those items, I will remove them from this list.

A TO Z ARIZONA, LLC

ALDURAN, LLC

BLAKE VAL VISTA GROUP, LLC

BLUE PINE DRIVE PARTNERSHIP, LLC

BURLEY AND ASSOCIATES, INC.

CHRYSALIS PUBLISHING, LTD.

DAN'S INVESTMENTS, LLC

DARBY OLSEN, LLC

DUVANTAR, LLC

DUVANTAR INVESTMENTS, LLC

DUVANTAR INVESTMENTS II, LLC

DUVANTAR INVESTMENTS III, LLC

EDUCATE ALLIE, LLC

EDUCATE BRIAN, LLC

ELERICH, LLC

HOMESTEAD GROUP PARTNERSHIP, LLC

INFINITE INVESTMENTS WORLDWIDE, LLC

KJP FREEDOM ENTERPRISES, LLC

LEHIGH MADISON, LLC

MARTHAMY PROPERTIES, LLC

MISSION POINTE, LLC

ODEN THOR, LLC

RANCHO CORTES, LLC

R.E.A.L. CHOICE HOLDINGS, LLC

RICHELE, LLC

SEVILLE INVESTMENTS, LLC

SHIELD HOME SOLUTIONS, INC.

SIR BEDIVERE GROUP PARTNERSHIP, LLC

SIR GARETH GROUP PARTNERSHIP, LLC

SIR GAWAIN GROUP PARTNERSHIP, LLC

SIR LUCAN GROUP PARTNERSHIP, LLC

SIR POLOMEDES GROUP PARTNERSHIP, LLC

STOVANA, LLC

TOPS GROUP PARTNERSHIP, LLC

VICTORY MEDICAL REGISTRY OF PHOENIX LLC

WATERFALLS GROUP PARTNERSHIP, LLC

XCEG, LLC

XDIG, LLC

XJEG, LLC

XLMG, LLC

XMTG, LLC

XNLG, LLC

XPAG, LLC

XSCG, LLC

Thursday, February 16, 2006

John Burley's Transactions

This is a list of all of the recorded documents related to John Burley, his wife Shari L Burley, and John Burley's business, Burley & Associates (B&A). I believe that there is more than one John R Burley in Maricopa county--that is, unless either Shari and Lillian Burley are the same person, or John Burley is a bigamist--which means that a small number (less than 10) of these items are probably not pertinent to the John Burley in question, associate of Robert Kiyosaki.

If you find a bad link then please let me know and I will correct it.

| Name | Doc Type | Date | Doc # |

| BURLEY JOHN R | DEED | 7/23/90 | 90-0326939 |

| BURLEY JOHN R | DEED TRST | 7/23/90 | 90-0326940 |

| BURLEY JOHN R | DEED | 7/23/90 | 90-0326941 |

| BURLEY JOHN R | DEED TRST | 7/23/90 | 90-0326942 |

| BURLEY JOHN R | WAR DEED | 8/2/90 | 90-0347939 |

| BURLEY JOHN R | DEED TRST | 8/2/90 | 90-0347940 |

| BURLEY JOHN R | DEED | 8/3/90 | 90-0348835 |

| BURLEY JOHN R | DEED TRST | 8/3/90 | 90-0348836 |

| BURLEY JOHN R | SALE AGR | 9/7/90 | 90-0404644 |

| BURLEY JOHN R | DEED | 9/11/90 | 90-0408729 |

| BURLEY JOHN R | DEED TRST | 9/11/90 | 90-0408730 |

| BURLEY JOHN R | A DEED TR | 2/20/91 | 91-0068364 |

| BURLEY JOHN R | A DEED TR | 2/20/91 | 91-0068365 |

| BURLEY JOHN R | A DEED TR | 2/20/91 | 91-0068390 |

| BURLEY JOHN R | A DEED TR | 2/20/91 | 91-0068440 |

| BURLEY JOHN R/LILLIAN N | JNT DEED | 8/13/91 | 91-0376148 |

| BURLEY JOHN R/LILLIAN N | DEED TRST | 8/13/91 | 91-0376149 |

| BURLEY SHARI | SPEC/W D | 12/11/91 | 91-0579238 |

| BURLEY SHARI | DISCLMR D | 12/11/91 | 91-0579239 |

| BURLEY SHARI | DEED TRST | 12/11/91 | 91-0579240 |

| BURLEY SHARI L | SPEC/W D | 6/24/92 | 92-0341948 |

| BURLEY SHARI L | DEED TRST | 6/24/92 | 92-0341949 |

| BURLEY SHARI ETAL | A DEED TR | 7/21/92 | 92-0397310 |

| BURLEY JOHN R ETAL | DEED TRST | 7/28/92 | 92-0412436 |

| BURLEY SHARI L ETAL | A DEED TR | 10/8/92 | 92-0566752 |

| BURLEY JOHN R ETAL | REL D/T | 1/21/93 | 93-0036209 |

| BURLEY JOHN R | SALE AGR | 8/12/93 | 93-0536582 |

| BURLEY JOHN R ETAL | NOTICE | 9/17/93 | 93-0630144 |

| BURLEY JOHN R ETAL | NOTICE | 10/4/93 | 93-0676360 |

| BURLEY SHARI ETAL | LIS PEND | 11/2/93 | 93-0756159 |

| BURLEY JOHN R ETAL | A DEED TR | 1/20/94 | 94-0051358 |

| BURLEY LILLIAN N ETAL | A DEED TR | 1/20/94 | 94-0051358 |

| BURLEY JOHN R ETAL | NOTICE | 2/7/94 | 94-0104425 |

| BURLEY JOHN R ETAL | NOTICE | 3/8/94 | 94-0190920 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/8/94 | 94-0190921 |

| BURLEY JOHN R ETAL | NOTICE | 3/8/94 | 94-0190922 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/8/94 | 94-0190923 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/8/94 | 94-0190924 |

| BURLEY JOHN R ETAL | NOTICE | 3/8/94 | 94-0190925 |

| BURLEY JOHN R ETAL | NOTICE | 3/8/94 | 94-0190926 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/8/94 | 94-0190927 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/8/94 | 94-0190928 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/8/94 | 94-0190929 |

| BURLEY JOHN R ETAL | NOTICE | 3/14/94 | 94-0205240 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/14/94 | 94-0205241 |

| BURLEY SHARI ETAL | REL L/P | 4/12/94 | 94-0294261 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 5/10/94 | 94-0373868 |

| BURLEY JOHN R ETAL | NOTICE | 5/10/94 | 94-0373869 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 5/10/94 | 94-0373870 |

| BURLEY JOHN R ETAL | NOTICE | 5/10/94 | 94-0373871 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 5/10/94 | 94-0373872 |

| BURLEY JOHN R ETAL | NOTICE | 5/10/94 | 94-0373873 |

| BURLEY JOHN R ETAL | NOTICE | 5/10/94 | 94-0373874 |

| BURLEY JOHN R ETAL | SALE AGR | 5/24/94 | 94-0415594 |

| BURLEY JOHN R ETAL | SALE AGR | 6/27/94 | 94-0498483 |

| BURLEY JOHN R ETAL | SALE AGR | 7/28/94 | 94-0572689 |

| BURLEY JOHN R ETAL | SALE AGR | 8/5/94 | 94-0593368 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685300 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685301 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685302 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685303 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685304 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685305 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685306 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685307 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685308 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685309 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685310 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/94 | 94-0685311 |

| BURLEY JOHN R ETAL | SALE AGR | 11/3/94 | 94-0790001 |

| BURLEY JOHN R ETAL | NOTICE | 2/16/95 | 95-0085969 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 2/16/95 | 95-0085970 |

| BURLEY JOHN R ETAL | NOTICE | 2/16/95 | 95-0085971 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 2/16/95 | 95-0085972 |

| BURLEY JOHN R ETAL | NOTICE | 2/16/95 | 95-0085973 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 2/16/95 | 95-0085974 |

| BURLEY JOHN R ETAL | NOTICE | 2/16/95 | 95-0085975 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 2/16/95 | 95-0085976 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 2/16/95 | 95-0085977 |

| BURLEY JOHN R ETAL | NOTICE | 2/16/95 | 95-0085978 |

| BURLEY JOHN R ETAL | NOTICE | 2/16/95 | 95-0085979 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 2/16/95 | 95-0085980 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 2/16/95 | 95-0085981 |

| BURLEY JOHN R ETAL | NOTICE | 2/16/95 | 95-0085982 |

| BURLEY JOHN R | SALE AGR | 7/21/95 | 95-0426915 |

| BURLEY JOHN R ETAL | PARTNRSHP | 8/8/95 | 95-0467813 |

| B&A INC ETAL | PARTNRSHP | 8/8/1995 | 95-0467813 |

| B&A INC ETAL | Q/CL DEED | 9/6/1995 | 95-0539185 |

| B&A INC ETAL | WAR DEED | 9/6/1995 | 95-0539186 |

| BURLEY JOHN R ETAL | DEC FORF | 9/19/95 | 95-0567623 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/95 | 95-0567624 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/95 | 95-0567625 |

| BURLEY JOHN R ETAL | DEC FORF | 9/19/95 | 95-0567626 |

| BURLEY JOHN R ETAL | DEC FORF | 9/19/95 | 95-0567627 |

| BURLEY JOHN R ETAL | NOTICE | 9/19/95 | 95-0567628 |

| BURLEY JOHN R ETAL | A DEED TR | 10/6/95 | 95-0612826 |

| BURLEY LILLIAN N ETAL | A DEED TR | 10/6/95 | 95-0612826 |

| BURLEY JOHN R ETAL | SALE AGR | 12/8/95 | 95-0756791 |

| BURLEY JOHN R | WAR DEED | 12/13/95 | 95-0766087 |

| BURLEY JOHN R | DISCLMR D | 12/13/95 | 95-0766088 |

| BURLEY SHARI L | DISCLMR D | 12/13/95 | 95-0766088 |

| BURLEY JOHN R | WAR DEED | 12/13/95 | 95-0766090 |

| B&A INC ETAL | NOTICE | 2/29/1996 | 96-0135267 |

| B&A INC ETAL | AFFIDAVIT | 4/30/1996 | 96-0294530 |

| B&A INC ETAL | NOTICE | 4/30/1996 | 96-0294531 |

| BURLEY JOHN R | SALE AGR | 5/23/96 | 96-0359169 |

| B&A INC ETAL | NOTICE | 7/23/1996 | 96-0514271 |

| B&A INC ETAL | AFFIDAVIT | 7/23/1996 | 96-0514272 |

| B&A INC ETAL | NOTICE | 2/20/1997 | 97-0107970 |

| B&A INC ETAL | AFFIDAVIT | 2/20/1997 | 97-0107971 |

| B&A INC ETAL | AFFIDAVIT | 3/12/1997 | 97-0159049 |

| B&A INC ETAL | NOTICE | 3/12/1997 | 97-0159050 |

| BURLEY JOHN R ETAL | NOTICE | 3/12/97 | 97-0159556 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/12/97 | 97-0159557 |

| BURLEY JOHN R | NOTICE | 3/21/97 | 97-0181315 |

| BURLEY JOHN R ETAL | WAR DEED | 3/27/97 | 97-0199094 |

| BURLEY JOHN R | WAR DEED | 4/3/97 | 97-0219188 |

| B&A INC ETAL | NOTICE | 4/11/1997 | 97-0235629 |

| B&A INC ETAL | AFFIDAVIT | 5/27/1997 | 97-0350964 |

| B&A INC ETAL | NOTICE | 5/27/1997 | 97-0350965 |

| BURLEY JOHN R | REL D/T | 6/6/97 | 97-0384378 |

| BURLEY JOHN R ETAL | AGREEMENT | 7/25/97 | 97-0500380 |

| BURLEY JOHN R ETAL | AGREEMENT | 7/25/97 | 97-0500381 |

| BURLEY JOHN R ETAL | AGREEMENT | 7/25/97 | 97-0500382 |

| BURLEY JOHN R ETAL | AGREEMENT | 7/25/97 | 97-0500383 |

| BURLEY JOHN R | WAR DEED | 7/25/97 | 97-0502316 |

| BURLEY JOHN R | REL D/T | 9/22/97 | 97-0656269 |

| BURLEY JOHN R ETAL | NOTICE | 11/26/97 | 97-0832146 |

| BURLEY SHARI | CIV JDG | 1/21/98 | 98-0041980 |

| BURLEY JOHN R | WAR DEED | 2/10/98 | 98-0102145 |

| BURLEY JOHN R | REL D/T | 3/30/98 | 98-0243823 |

| BURLEY JOHN R | WAR DEED | 4/21/98 | 98-0322154 |

| BURLEY SHARI ETAL | WAR DEED | 4/21/98 | 98-0322154 |

| B&A INC ETAL | AFFIDAVIT | 5/11/1998 | 98-0387713 |

| B&A INC ETAL | NOTICE | 6/1/1998 | 98-0456671 |

| B&A INC ETAL | AFFIDAVIT | 6/1/1998 | 98-0456672 |

| B&A INC ETAL | NOTICE | 6/1/1998 | 98-0456673 |

| B&A INC ETAL | AFFIDAVIT | 6/1/1998 | 98-0456674 |

| BURLEY JOHN R | POWER ATT | 8/24/98 | 98-0745498 |

| BURLEY JOHN R | DEED TRST | 8/28/98 | 98-0767538 |

| BURLEY JOHN R ETAL | A DEED TR | 8/28/98 | 98-0767539 |

| BURLEY JOHN R | WAR DEED | 9/1/98 | 98-0781654 |

| BURLEY JOHN R | WAR DEED | 9/1/98 | 98-0781655 |

| BURLEY JOHN R ETAL | JNT DEED | 10/7/98 | 98-0900649 |

| BURLEY SHARI L ETAL | JNT DEED | 10/7/98 | 98-0900649 |

| BURLEY JOHN R ETAL | WAR DEED | 10/7/98 | 98-0900651 |

| BURLEY SHARI L ETAL | WAR DEED | 10/7/98 | 98-0900651 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 10/8/98 | 98-0901155 |

| BURLEY JOHN R ETAL | NOTICE | 10/8/98 | 98-0901156 |

| BURLEY JOHN R ETAL | Q/CL DEED | 10/16/98 | 98-0928534 |

| B&A INC ETAL | Q/CL DEED | 10/16/1998 | 98-0928534 |

| BURLEY JOHN R | JNT DEED | 11/30/98 | 98-1078914 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 12/29/98 | 98-1179820 |

| B&A ETAL | AFFIDAVIT | 12/29/1998 | 98-1179820 |

| BURLEY JOHN R ETAL | NOTICE | 12/29/98 | 98-1179821 |

| B&A INC ETAL | NOTICE | 12/29/1998 | 98-1179821 |

| B&A INC ETAL | NOTICE | 12/29/1998 | 98-1179826 |

| B&A INC ETAL | AFFIDAVIT | 12/29/1998 | 98-1179827 |

| BURLEY JOHN R | REL D/T | 1/14/99 | 99-0035453 |

| BURLEY JOHN R ETAL | ASG MORT | 1/21/99 | 99-0057952 |

| BURLEY JOHN R ETAL | NOTICE | 2/2/99 | 99-0101499 |

| B&A ETAL | NOTICE | 2/2/1999 | 99-0101499 |

| BURLEY JOHN R ETAL | NOTICE | 2/9/99 | 99-0125409 |

| BURLEY JOHN R | POWER ATT | 3/1/99 | 99-0196842 |

| BURLEY JOHN R ETAL | SALE AGR | 3/4/99 | 99-0209248 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 3/5/99 | 99-0214941 |

| BURLEY JOHN R | NOTICE | 4/9/99 | 99-0340698 |

| BURLEY JOHN R | NOTICE | 7/14/99 | 99-0666363 |

| BURLEY JOHN R | Q/CL DEED | 7/26/99 | 99-0701077 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 8/5/99 | 99-0738841 |

| B&A INC ETAL | AFFIDAVIT | 8/5/1999 | 99-0738841 |

| B&A INC | NOTICE | 9/3/1999 | 99-0836018 |

| BURLEY JOHN R ETAL | MOD AG SL | 10/12/99 | 99-0939202 |

| BURLEY JOHN R | Q/CL DEED | 10/12/99 | 99-0939203 |

| BURLEY SHARI L | Q/CL DEED | 10/12/99 | 99-0939203 |

| BURLEY JOHN R ETAL | DEED + | 10/12/99 | 99-0939204 |

| BURLEY JOHN R | POWER ATT + | 10/12/99 | 99-0940454 |

| BURLEY JOHN R | Q/CL DEED | 10/12/99 | 99-0940455 |

| BURLEY JOHN R | Q/CL DEED | 10/12/99 | 99-0940457 |

| BURLEY SHARI L | Q/CL DEED | 10/12/99 | 99-0940457 |

| BURLEY JOHN R ETAL | DEED + | 10/12/99 | 99-0940458 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 10/12/99 | 99-0940462 |

| BURLEY JOHN R | Q/CL DEED | 10/12/99 | 99-0940463 |

| BURLEY JOHN R ETAL | WAR DEED | 11/12/99 | 99-1035529 |

| B&A INC ETAL | NOTICE | 1/14/2000 | 00-0032561 |

| B&A INC ETAL | NOTICE | 1/14/2000 | 00-0032562 |

| BURLEY JOHN R | POWER ATT | 2/14/00 | 00-0108550 |

| BURLEY JOHN R | POWER ATT | 2/14/00 | 00-0108551 |

| BURLEY JOHN R | POWER ATT | 2/14/00 | 00-0108552 |

| BURLEY JOHN R | POWER ATT | 2/14/00 | 00-0108553 |

| BURLEY JOHN R | POWER ATT | 2/14/00 | 00-0108554 |

| BURLEY JOHN R | AFFIDAVIT | 2/29/00 | 00-0145448 |

| BURLEY JOHN R | POWER ATT | 3/9/00 | 00-0177971 |

| BURLEY JOHN R ETAL | NOTICE | 5/8/01 | 01-0383896 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 5/8/01 | 01-0383897 |

| BURLEY JOHN R ETAL | AFFIDAVIT | 5/29/01 | 01-0451858 |

| BURLEY JOHN R | Q/CL DEED | 8/28/01 | 01-0793828 |

| BURLEY JOHN R ETAL | SPEC/W D | 9/13/01 | 01-0844503 |

| BURLEY SHARI L ETAL | SPEC/W D | 9/13/01 | 01-0844503 |

| BURLEY JOHN R ETAL | DEED TRST | 9/13/01 | 01-0844504 |

| BURLEY SHARI L ETAL | DEED TRST | 9/13/01 | 01-0844504 |

| BURLEY JOHN R | Q/CL DEED | 10/3/01 | 01-0920244 |

| BURLEY SHARI L | Q/CL DEED | 10/3/01 | 01-0920244 |

| BURLEY JOHN R | Q/CL DEED | 1/25/02 | 02-0078747 |

| BURLEY JOHN R | A DEED TR | 3/11/02 | 02-0247220 |

| BURLEY SHARI L | A DEED TR | 3/11/02 | 02-0247220 |

| BURLEY JOHN R | NOTICE | 3/11/02 | 02-0249087 |

| B&A | SALE AGR | 4/18/2002 | 02-0398233 |

| BURLEY JOHN R | AFFIDAVIT | 4/26/02 | 02-0430434 |

| BURLEY SHARI | WAR DEED | 5/13/02 | 02-0491098 |

| BURLEY SHARI | Q/CL DEED | 5/13/02 | 02-0491099 |

| BURLEY SHARI L | DISCLMR D | 5/17/02 | 02-0511578 |

| BURLEY JOHN R | SPEC/W D | 6/20/02 | 02-0627019 |

| BURLEY JOHN R | DISCLMR D | 6/20/02 | 02-0627020 |

| BURLEY SHARI L | DISCLMR D | 6/20/02 | 02-0627020 |

| BURLEY JOHN R | DEED TRST | 6/20/02 | 02-0627021 |

| BURLEY SHARI L | DEED TRST | 6/20/02 | 02-0627021 |

| BURLEY JOHN R | Q/CL DEED | 7/24/02 | 02-0746353 |

| BURLEY JOHN R | POWER ATT | 8/5/02 | 02-0795717 |

| BURLEY JOHN R | POWER ATT | 8/5/02 | 02-0795720 |

| BURLEY JOHN R | POWER ATT | 8/5/02 | 02-0795722 |

| BURLEY JOHN R | POWER ATT | 8/7/02 | 02-0805511 |

| BURLEY JOHN R | MUNI DOC + | 10/7/02 | 02-1037920 |

| BURLEY JOHN R | Q/CL DEED | 10/16/02 | 02-1070709 |

| BURLEY JOHN R | POWER ATT | 11/27/02 | 02-1266513 |

| BURLEY JOHN R | WAR DEED | 12/4/02 | 02-1296930 |

| BURLEY JOHN R | DISCLMR D | 12/4/02 | 02-1296931 |

| BURLEY SHARI LOU | DISCLMR D | 12/4/02 | 02-1296931 |

| B&A INC | DEED TRST | 12/20/2002 | 02-1381020A |

| BURLEY JOHN R | SUB TRSTE + | 8/1/03 | 03-1033878 |

| BURLEY JOHN R | POWER ATT | 8/1/03 | 03-1035558 |

| BURLEY JOHN R | SALE AGR | 9/30/03 | 03-1370454 |

| BURLEY JOHN R | JNT DEED | 12/16/03 | 03-1694857 |

| BURLEY JOHN R | REL D/T | 1/16/04 | 04-0048029 |

| BURLEY LILLIAN N | REL D/T | 1/16/04 | 04-0048029 |

| BURLEY JOHN R | REL D/T | 1/22/04 | 04-0061725 |

| BURLEY JOHN R | Q/CL DEED | 4/15/04 | 04-0404721 |

| BURLEY JOHN R | WAR DEED | 4/19/04 | 04-0415177 |

| BURLEY JOHN R | Q/CL DEED | 4/23/04 | 04-0438065 |

| BURLEY JOHN R | Q/CL DEED | 4/23/04 | 04-0438066 |

| BURLEY SHARI | Q/CL DEED | 4/23/04 | 04-0438066 |

| BURLEY JOHN R | Q/CL DEED | 5/26/04 | 04-0593061 |

| BURLEY SHARI | Q/CL DEED | 5/26/04 | 04-0593061 |

| BURLEY JOHN R | Q/CL DEED | 6/7/04 | 04-0641256 |

| BURLEY SHARI | Q/CL DEED | 6/7/04 | 04-0641256 |

| BURLEY JOHN R | DEED TRST | 6/7/04 | 04-0641257 |

| BURLEY JOHN R | DEED TRST | 6/7/04 | 04-0641266 |

| BURLEY SHARI | REL D/T | 6/30/04 | 04-0746725 |

| BURLEY JOHN R | DEED TRST | 7/22/04 | 04-0837281 |

| BURLEY JOHN R | WAR DEED | 8/17/04 | 04-0955516 |

| BURLEY JOHN R | DISCLMR D | 8/17/04 | 04-0955517 |

| BURLEY SHARI | DISCLMR D | 8/17/04 | 04-0955517 |

| BURLEY JOHN R | DEED TRST + | 8/17/04 | 04-0955518 |

| BURLEY JOHN R | ASSIGNMNT | 8/17/04 | 04-0955519 |

| BURLEY JOHN R | ASSIGNMNT | 8/17/04 | 04-0955520 |

| BURLEY JOHN R | REL D/T | 12/7/04 | 04-1434913 |

| BURLEY SHARI L | REL D/T | 12/7/04 | 04-1434913 |

| BURLEY JOHN R | DEED | 3/14/05 | 05-0309081 |

| BURLEY JOHN R | JNT DEED | 5/5/05 | 05-0593122 |

| BURLEY SHARI L | JNT DEED | 5/5/05 | 05-0593122 |

| BURLEY SHARI | DEED TRST | 5/5/05 | 05-0593123 |

| BURLEY JOHN R | REL D/T | 6/23/05 | 05-0856430 |

| BURLEY JOHN R | REL D/T | 7/12/05 | 05-0959631 |

| B&A | LIS PEND | 8/2/2005 | 05-1097230 |

| BURLEY JOHN R | REL D/T | 8/22/05 | 05-1206047 |

| BURLEY SHARI L | DISCLMR D | 1/26/06 | 06-0118458 |

| BURLEY SHARI LOU | DISCLMR D | 1/26/06 | 06-0118458 |